New Bill to Boost EV Manufacturing in USA

NEWS

The Inflation Reduction Act will spur domestic investment in electric vehicle technology and manufacturing. Photo courtesy General Motors

WASHINGTON—President Joe Biden recently signed the much-anticipated Inflation Reduction Act, which promises to spur domestic investment in electric vehicle technology. The bipartisan legislation includes automotive manufacturing and consumer purchase incentives to expand vehicle electrification in the United States.

“Automakers are committed to the electric future and the production of groundbreaking EVs,” says John Bozzella, president and CEO of the Alliance for Automotive Innovation. “For the transformation to electrified transportation to really take hold, it requires more than just EVs with cutting-edge performance, design and technology.

“This is a massive undertaking and government has a role to play when it comes to establishing the right conditions for global leadership and success,” explains Bozzella. “The manufacturing tax credits and grant funding will help accelerate the domestic industrial base conversion currently underway.

“Unfortunately, the EV tax credit requirements will make most vehicles immediately ineligible for the incentive,” claims Bozzella. “That’s a missed opportunity at a crucial time and a change that will surprise and disappoint customers in the market for a new vehicle. It will also jeopardize our collective target of 40 percent to 50 percent electric vehicle sales by 2030.”

For a transformation like this to succeed, Bozzella believes that many supportive policies beyond the auto industry’s control must be in place, such as: new supply chains that incorporate national security allies; usable manufacturing and consumer tax incentives; expedited permitting for critical mineral mining and related processing; and ubiquitous charging infrastructure across the United States.

Automotive manufacturing provisions in the Inflation Reduction Act include the following:

- Extension of the Advanced Energy Project Credit. Expands the qualifications for, and allocation of, advanced energy project credits. Within 180 days of enactment, a program must be implemented by the Treasury Department to grant certification to applications. The provision allows the Secretary to allocate an additional $10 billion in tax credits to qualifying projects. Eligibility is expanded to include projects to establish, expand or reequip facilities for advanced light, medium and heavy-duty vehicles, and related components and infrastructure.

- Advanced Manufacturing Production Credit. Provides an outline of credits available to those entities that produce materials used for clean energy production. Materials eligible for credits include the production of electrode active materials, battery cells, battery modules and applicable critical minerals. Credit phase outs do not apply to the production of critical minerals.

- Advanced Technology Vehicle Manufacturing. Appropriates $3 billion for the Secretary of Energy to make direct loans for the cost of establishing or expanding U.S. manufacturing facilities that produce advanced technology vehicles or components with low or zero greenhouse gas emissions.

- Domestic Manufacturing Conversion Grants. Appropriates $2 billion for grants for electric hybrid, plug-in electric hybrid, plug-in electric drive and hydrogen fuel cell electric vehicles.

- Defense Production Act Funding. Includes $500 million (available until September 2024) for additional incentives to spur onshoring for critical minerals.

See us at The Assembly Show, Booth 305

Foxconn to Build Electric Tractors, Batteries for Monarch

Foxconn will assemble vehicles for Monarch Tractor at its assembly plant in Lordstown, OH. Photo courtesy Monarch Tractor

LORDSTOWN, OH—Foxconn has signed an agreement to manufacture Monarch Tractor’s battery packs and electric agricultural equipment at its assembly plant here.

“This partnership reflects Foxconn’s growing center of gravity for autonomous electric vehicle production and the potential that can emerge from forward-thinking collaborations,” says Young Liu, chairman of Foxconn.

Full-rate production of Monarch Tractor’s MK-V Series is scheduled to begin in the first quarter of 2023. Monarch will begin manufacturing its Founder Series tractor at its assembly plant in Livermore, CA, in the fourth quarter of 2022.

In May 2022, Foxconn acquired the Lordstown assembly plant from EV maker Lordstown Motors Corp., which acquired it from General Motors in November 2019.

Transitioning to EVs Puts Extra Burden on Supply Chains

It will take more than a decade before EVs benefit from the economies of scale that support the ICE vehicle market. Photo courtesy BMW Group

DETROIT—Legacy automakers have already committed more than $500 billion in EV investments to transform themselves. However, if not properly managed, the transition from traditional supply bases could cost an additional $70 billion.

According to AlixPartners, one big challenge involves battery raw material costs that are up to 125 percent higher than internal combustion engine (ICE) costs. Other bottlenecks include scarcity and price inflation of parts and commodities (including increased use of chips on EVs), and a lack of readiness for the EV era in the supply bases of both automakers and Tier One suppliers.

“Automakers and suppliers are benefiting from strong demand despite the economic clouds and are showing resolve in their commitment to shift to electric vehicles,” explains Mark Wakefield, global co-leader of the automotive and industrial practice at AlixPartners. “But, expectations are high for the industry to hit record profit levels these next two years, even while funding for the beginning of the EV transition is taking place ahead of sufficient volumes for economies-of-scale and cost competitiveness.

“While many companies are planning their own transition, proactive supply chain redesign and rigorous cost management needs to be improved to avoid costly surprises down the road,” warns Wakefield.

In the future, Wakefield says the chip shortage could disproportionately affect EV production, since battery-powered vehicles require more chips than their ICE counterparts. Chip demand from EVs is projected to grow 55 percent per year, compared to a decline in demand for ICEs.

At $3,662 per vehicle in the United States, ICE raw material content is nearly double prepandemic levels. This pales in comparison to EV raw material content, which is now $8,255 per vehicle. According to the AlixPartners study, this disparity is driven largely by cobalt, nickel and lithium prices.

“Incumbent suppliers battle new entrants and the OEMs themselves for the $9,000 in cost added in an EV power train, while seeing a decline of a full $5,000 in ICE-related power train components,” notes Wakefield. He believes investment demands will snowball as EV penetration accelerates and infrastructure needs mature.

It will take more than a decade before EVs benefit from the economies of scale that support the ICE vehicle market. During that time period, suppliers will be particularly vulnerable, because the available content per vehicle drops as new entrants, including battery and technology suppliers, become competitors, and as automakers choose to make more of the new components themselves to transition plants and people skills to EVs.

Suppliers appear to have access to only 28 percent of new EV power train production value as a result, claims the AlixPartners analysis. And this transition is taking place as many suppliers are planning to wind down or sell their ICE-related business units.

Wakefield believes automakers and suppliers must explore innovative models to facilitate the ICE-to-EV transition, including potentially separating businesses. “This can help ensure robust capital allocation for value creation at a time of sky-high investor expectations, while enabling new, faster clock-speed EV businesses to grow rapidly,” he points out.

Panasonic to Build Huge EV Battery Factory in Kansas

Panasonic plans to build a $4 billion lithium-ion battery manufacturing plant near Kansas City. Photo courtesy Panasonic Energy Co.

TOPEKA, KS—Panasonic Energy Co. plans to build a $4 billion lithium-ion battery manufacturing plant at a potential site in De Soto, KS. The facility would be located on the site of the former Sunflower Army Ammunition Plant, which was built during World War II.

"With the increased electrification of the automotive market, expanding battery production in the U.S. is critical to help meet demand," says Kazuo Tadanobu, president and CEO of Panasonic Energy Co. "Given our leading technology and depth of experience, we aim to continue driving growth of the lithium-ion battery industry and accelerating toward a net-zero emissions future."

The announcement comes five years after Panasonic Group began mass-producing lithium-ion batteries at Panasonic Energy of North America (PENA) in Sparks, NV. PENA, a key supplier to Tesla, is now one of the world's largest battery factories, surpassing 6 billion EV battery cells shipped. While PENA's operations will continue, Tadanobu says the new facility in Kansas is intended to further support Panasonic’s long-term commitment to advancing the EV industry in the United States.

Walmart Order Breaths New Life Into Canoo

Walmart plans to purchase more than 4,000 electric delivery vans from Canoo. Photo courtesy Canoo Inc.

BENTONVILLE, AR—Walmart Inc. plans to purchase more than 4,000 electric delivery vans from Canoo Inc. With options to eventually acquire up to 10,000 EVs, the announcement has breathed new life into the startup automaker, which has been struggling to ramp up production. However, the deal prevents Canoo from selling its vehicles to Amazon, which already has a contract with Rivian Automotive.

The Lifestyle Delivery Vehicle (LDV) will be assembled in Pryor, OK. It is designed for last-mile small package and grocery delivery applications. The vehicle will be built on a multi-purpose platform that integrates the motors, battery module and other components.

“Our LDV has the turning radius of a small passenger vehicle on a parking friendly, compact footprint, yet the payload and cargo space of a commercial delivery vehicle,” claims Tony Aquila, chairman and CEO of Canoo. “This is the winning algorithm to seriously compete in the last-mile delivery race. Walmart's massive store footprint provides a strategic advantage in today's growing 'need it now' mindset and an unmatched opportunity for growing EV demand, especially at today's gas prices."

REE Plans Integrated Assembly Strategy

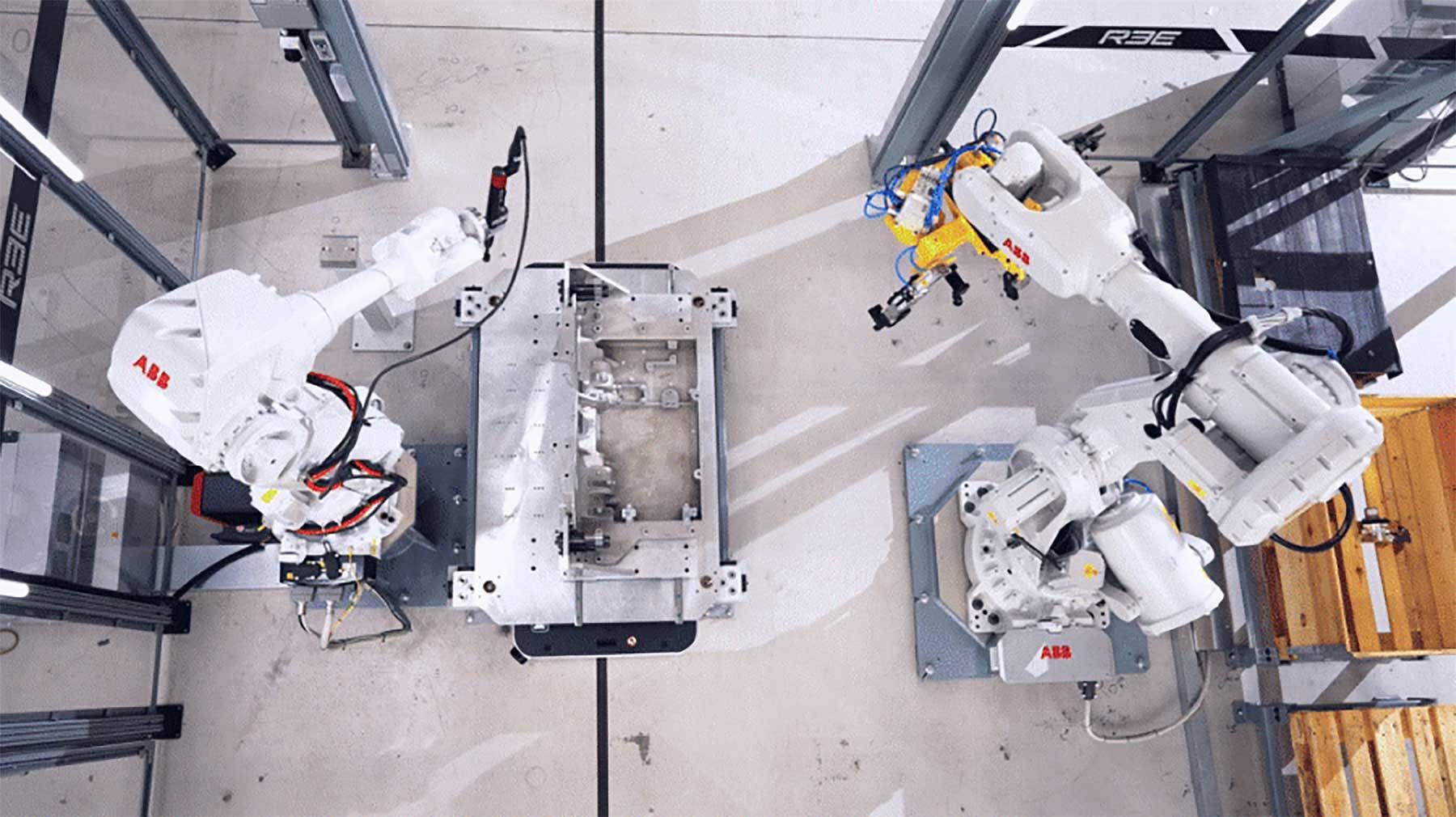

REE Automotive plans to build modular, flexible assembly lines to mass-produce EV platforms. Photo courtesy REE Automotive Ltd.

AUSTIN, TX—REE Automotive Ltd. is on a mission to revolutionize e-mobility from the ground up, changing the way that electric vehicles are designed and manufactured. The company specializes in EV platforms and modular components.

Its REEcorner technology packs traditional drive components, such as braking, control, power train, steering and suspension, into a single compact module between the chassis and the wheel, using x-by-wire technology for steering, driving and braking.

This innovation has enabled REE to develop a modular, fully-flat skateboard chassis with more room for passengers, cargo and batteries that it claims is highly adaptable to a variety of vehicle configurations and applications. EV platforms using REEcorners are agnostic to vehicle size and design, power source and driving mode, which enables new mobility players to get to market faster at a fraction of the cost.

REE’s production strategy relies on suppliers such as American Axle & Manufacturing Inc., which will be producing the 3-in-1 electric propulsion system. Those components and subassemblies will be attached to chassis at the company’s in-house integration centers. The first facility in Coventry, England, will open later this year, followed by a second operation in Texas next year.

“We’ve adopted a unique model for production intended to increase manufacturing efficiencies and accelerate our EV platforms and EV components’ time to market,” says Josh Tech, chief operating officer at REE. “Our modular production line concept is also highly automated, flexible and common to all integration centers regardless of location, meaning that we can scale up or down depending on future variants and demand.”

Tech, a former Tesla manufacturing executive, claims that REE will use a production strategy that provides “much greater flexibility and scalability than a traditional production line.” It will feature robotic assembly stations and end-of-line electrical test stations. Automated guided vehicles will move work-in-process between workstations for both automated and manual assembly tasks, while autonomous mobile robots will bring subassemblies to the line.

According to Tech, the modular production line will provide “countless advantages,” including the ability to validate all assembly cells quickly by testing and optimizing one cell and then implementing best practices across the others, which he claims will dramatically reduce the time needed to design and develop assembly lines.

“The modular production line is also highly automated and flexible, meaning that we can scale up or down depending on future variants and demand,” Tech points out. “In addition, assembly cells and production lines can be efficiently lifted and installed at future integration centers, as required, as we apply one global standard using the plug-and-play format.”