Beverage

R&D

Getting ‘sweet’ on plant-based sweeteners

By Barbara Harfmann

Stevia represents 6% of new product beverage launches in 2021

(Image courtesy of Adallen Nutrition)

It wasn’t even the Super Bowl, but the Jan. 23 AFC divisional round playoff game between the Kansas City Chiefs and the Buffalo Bills at Arrowhead Stadium will go down as one of the greatest of all time. In the last two minutes of regulation, quarterbacks Patrick Mahomes and John Allen combined for 25 points resulting in a 36-36 tie as time ran out. In overtime, Kansas City won in thrilling fashion when Mahomes connected with tight end Travis Kelce for a walk-off touchdown. In the sweeteners market, no- and low-calorie natural plant-based sweeteners like stevia, erythritol and monk fruit are “winning big” in the beverage “game.”

Nate Yates, global platform lead for sugar reduction and specialty sweeteners at Westchester, Ill.-based Ingredion, says that sugar reduction ranks as the top way to make processed foods and beverages healthier.

“Sugar content is what consumers now look for most often on front-of-pack,” Yates says. “This has created tremendous interest and opportunity for beverage companies to formulate with ingredients like stevia, erythritol and allulose. Our customers partner with us to use zero calorie ingredients to create taste experiences consistent with their full sugar counterparts.”

Carla Saunders, senior marketing manager for high-intensity sweeteners at Minneapolis-based Cargill, expresses similar sentiments. “We continue to see the use rate of sweeteners like stevia and erythritol grow at double-digit rates, especially as consumers pay more attention to their health and well-being,” she says.”

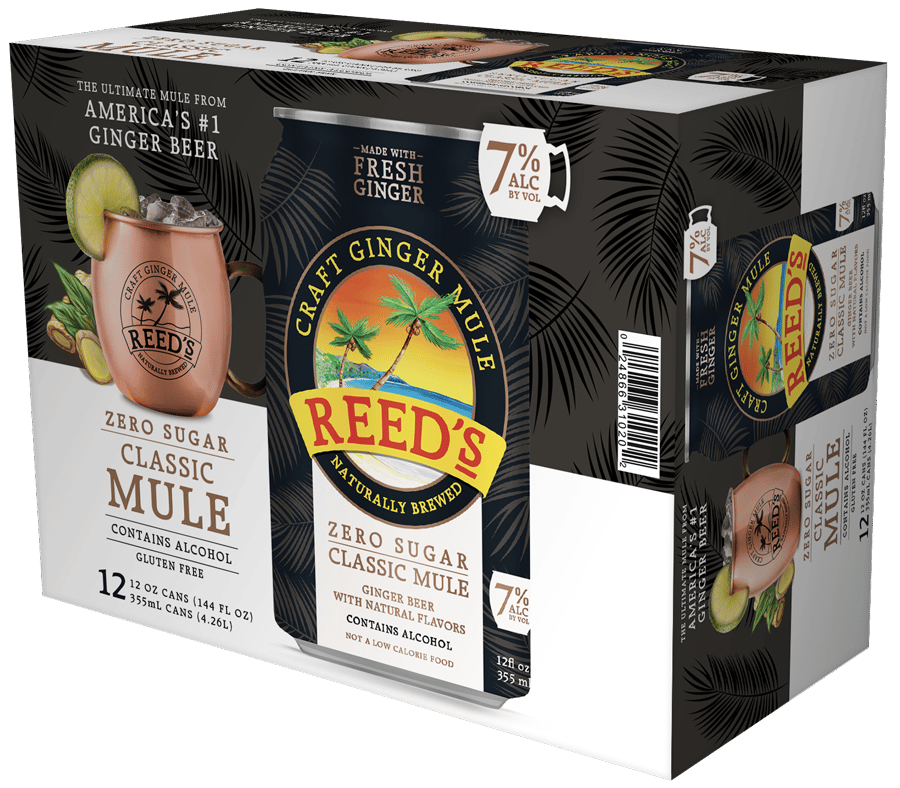

Recently launched at 28 Costco locations throughout Florida, South Carolina, Tennessee and Georgia, the 7% ABV Reeds Zero Sugar Classic Mule are packed with fresh ginger root, zero added sugar and sweetened with organic erythritol and organic Reb A, the company says.

Likewise, Cranbury, N.J.-based Adallen Nutrition’s Malcolm Greenberg, vice president of sales for NOAM, notes that usage rates of the company’s monk fruit, stevia and monk fruit/erythritol blends, both conventional and organic, have skyrocketed.

“People are paying a great deal of attention to their overall health and well-being. They are moving away in droves from artificial sweeteners,” he says. “Americans have a sweet tooth and this had led to an increase in obesity and other health issues over the decades. In the efforts to alleviate these issues, artificial sweeteners may decrease calories, yet there have been animal studies that convincingly prove that artificial sweeteners cause weight gain, brain tumors, bladder cancer and many other health hazards.”

Beverage-makers are turning to monk fruit, stevia, and monk fruit/erythritol blends in ready-to-drink (RTD) protein drinks, carbonated soft drinks, energy drinks, flavored waters, water enhancers, hard seltzers, coffee drinks, sports nutrition, recovery drinks, nutritional supplements and more, experts say.

“In the U.S., stevia and monk fruit have been primary growth drivers for the beverage market, with year-over-year volume growth of products containing these sweeteners at 12% and 26% respectively, per Nielsen,” says David Nichols, senior manager for category strategy and planning at Tate & Lyle, Hoffman Estates, Ill.

Tate & Lyle offers more than 15 branded sweetener ingredients in its portfolio across four main areas: high-potency sweeteners, rare sugars, bulking sweeteners and flavors. The company’s sweetener portfolio provides innovative formulations with a lower sugar content, which offers better nutrition at a low manufacturing cost, Nichols says.

“Our understanding of sweeteners built over several decades, and our broad portfolio have given Tate & Lyle unique expertise in optimizing sweetness in beverages when reducing sugar and calories,” Nichols explains. “Our sweeteners help reduce sugar and calories without compromising the taste and mouthfeel consumers know and want. Balancing our different sweeteners and leveraging their synergies creates fine-tuned dosages and lower cost in use.”

According to MarketsandMarkets, in 2020, the global natural sweeteners market was $2.8 billion. Yet, the pot for sweeteners is becoming more satisfying as more applications across the food and beverage industry are driving growth of natural sweeteners, it says. In fact, the market research firm projects the market will grow to $3.8 billion by 2025, posting a compound annual growth rate (CAGR) of 6.1%.

(Video courtesy of Cargill)

The fact that consumers are familiar with the names of natural sweeteners on beverage labels also is boosting sales. Data from Chicago-based ADM’s Outside Voice survey found that 69% of consumers say simple, recognizable ingredients influence their purchasing decisions, and 66% say they are looking for labels with the shortest ingredients list.

“Sweeteners from plant-based sources that consumers recognize, such as stevia, are helping meet consumers’ clean-label demands while also keeping reduced-sugar beverages tasting just right,” says Sarah Diedrich, ADM’s marketing director of global sweetening and texturizing. “Plus, our research shows that stevia is among the top sweeteners consumers are interested in trying in their foods and beverages, especially as it tends to be a known and trusted ingredient from a natural source.

“We’re seeing this reflected in the marketplace, particularly with anticipated growth rates climbing for high-intensity sweeteners. For instance, stevia has a CAGR of 0.9% for 2021-2026,” Diedrich continues. “Additionally, beverages are a key part of sweeteners’ growth, and, in fact, over 40% of the category share using sweeteners in 2021 was beverages, bypassing all other categories by a large margin.”

For the 52 weeks ending Oct. 9, 2021, New York-based Nielsen reported that stevia-sweetened beverages totaled $1.4 billion, growing at a CAGR of 11.6% from 2017-2021. For comparison, total beverage category sales for the same period were up 7.1%.

Fermented sugarcane Reb M is the latest addition to the PureCircle by Ingredion stevia portfolio. The patented fermenting process converts sugarcane into a zero-calorie sweetener with no bitter aftertaste, Carla Saunders says. (Image courtesy of Ingredion)

Citing Chicago-based Mintel’s GNPD database, stevia, monk fruit, allulose and erythritol have increased their adoption in U.S. beverage new product launches, collectively accounting for 10% of new product launches in 2021 vs. 8% in 2020, Tate & Lyle’s Nichols says.

“Stevia is the ingredient utilized most, representing 6% of all U.S. beverage new product launches in 2021,” he adds.

Sugar reduction top of mind

When it comes to health and wellness, sugar reduction is foremost in the minds of consumers and the global pandemic has only heightened that concern. Reducing sugar intake to reduce waistlines and maintain overall health is a top priority for many consumers.

Clean-label trends also are driving growth. Thom King, CEO of Icon Foods, Portland, Ore., reports an increase of more than 50% across all of its clean-label, non-nutritive sweeteners.

“One of the underlying pre-existing conditions related to COVID severity was and still is metabolic disease. This has not escaped the eye of the consumer who knows sugar is the culprit and they avoid added sugars,” King says. “… The biggest emerging category for stevia and monk fruit use would be probiotic, prebiotic and adaptogenic RTD beverages. These consumers demand a clean label, and concerns over immune health have propelled the category.”

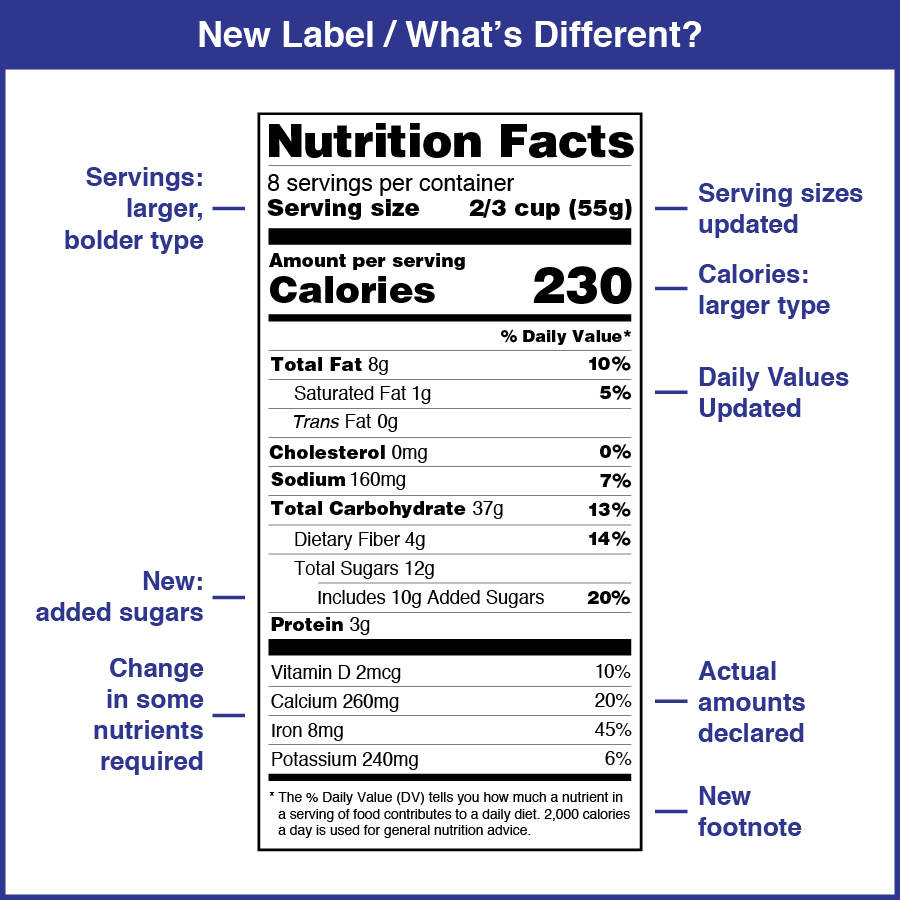

The U.S. Food and Drug Administration requires manufacturers to disclose added sugar content on nutrition labels. (Image courtesy of the U.S. Food and Drug Administration)

A May 2021 report from the International Food Information Council report found that after No. 1 ranked honey, the low-calorie sweeteners consumers were most likely to consume were stevia, monk fruit sweeteners and sucralose.

Reducing sugar is the No. 1 dietary change that consumers have made during the past year, according to HealthFocus International, St. Petersburg, Fla. In its “Navigating the World of Sweeteners” report, the research firm explores the ways shoppers are managing sugar intake globally, regionally and across 22 countries.

“Findings show that when shoppers are attempting to cut back on sugar — they want to reduce, rather than replace with alternative sweeteners or other flavors,” it states.

The following are some of the report’s findings:

- 5 out of 10 are choosing foods/beverages that are less sweet.

- 4 out of 10 are choosing unsweet foods/beverages.

- 2 out of 10 are consuming foods/beverages with non-sugar sweeteners.

- 2 out of 10 are choosing foods/beverages that substitute other flavors for sugar.

“Beverage formulators are like chefs. Similar ingredients, yet the usage levels change based on what the end result is planned for. A soda manufacturer will use a different combination of sweeteners than a protein beverage manufacturer will.”

— Malcolm Greenberg, vice president of sales for NOAM at Adallen Nutrition

American adults consume an average of 18-19 teaspoons (75-79 grams) of sugar a day, more than three times the recommended amount. This translates into about 60 pounds of added sugar consumed each year, for each person, according to the Centers for Disease Control (CDC). Nutritionists suggest that Americans should get only 10% of their calories from sugar, or 13.3 teaspoons of sugar a day (based on 2,000 calories a day).

Meeting sugar-reduction targets

Consumers demanding healthier, functional beverages with less processed sugar have led them to scrutinize labels like never before. As of January 2021, the FDA began requiring food manufacturers to disclose added sugar content on nutrition labels. As a result, many companies are looking for ways to trim added sugar, naturally.

“Consumers are demanding healthier beverages. This demand has led to substantial growth in no-added-sugar, clean label, fortified beverages designed to be functional, enhance immunity and promote gut health,” Icon’s King says.

Ingredient suppliers are seeing “tremendous opportunity” for natural sweeteners within better-for-you beverages.

For an ideal sugar replacer, a one-to-one blend of monk fruit/erythritol is a diabetic safe, low-sugar and low-calorie option in beverages, snacks and dietary supplements, Malcolm Greenberg says. (Image courtesy of Adallen Nutrition)

Ingredion’s Yates explains: “Emerging sweetening alternatives like stevia and allulose have expanded the sugar reduction toolkit for beverage formulators. Allulose is a versatile ingredient in sugar reduction solutions, as it not only offers sugar-like sweetness, but can serve as a functional build back tool in replicating the browning and mouthfeel of sugar.

“PureCircle by Ingredion has the broadest portfolio of stevia solutions for beverage companies, which includes our range of flavorings with modifying properties (FMPs),” he continues. “These ingredients are labeled as natural flavors, but provide a range of taste enhancements from improving sweetness quality, masking offnotes like proteins and amplifying flavor notes like vanilla and cocoa.”

The company also offers PureCirce Reb M from stevia leaf extract, bioconversion and fermentation technologies, which provides a tasty, cost-effective and more sustainable ingredient solution for its beverage customers and tailored to their specific need, he notes.

Additionally, Cargill’s comprehensive stevia portfolio includes Truvia Reb A stevia leaf extracts; a ViaTech line, which leverages the full power of the leaf and offers tailored solutions for specific applications; and its premier stevia sweetener EverSweet, which, through fermentation, gives brands access to the sweetest components of the stevia leaf ― Reb M and Reb D — which comprise less than 1% of the stevia leaf.

Through fermentation in partnership with DSM, Cargill is able to produce its flagship product with less water, less land and a smaller carbon footprint, Saunders says.

The company’s newest entry, EverSweet + ClearFlo, takes sugar reduction to the next level by delivering enhanced flavor modification characteristics, faster dissolution, improved solubility and greater stability in formulations, she adds.

“EverSweet + ClearFlo stands apart from anything else in the marketplace as the sweetener system addresses solubility, dissolution, improves taste and is label friendly,” she explains. “… Using EverSweet’s quick sweetness onset and high sweetness potency as a foundation, EverSweet + ClearFlo goes a step further to create an even more sugar-like experience, especially at higher concentrations.”

The new system also helps manage off flavors from other ingredients used in formulation such as earthy notes from proteins, bitterness from caffeine or metallic tastes from potassium chloride, she adds.

The magic of monk fruit

When it comes to natural sweeteners, the zero-calorie monk fruit, or lo han guo, is making its mark within food, beverage and nutritional supplements, according to Adallen Nutrition’s Greenberg. Adallen Nutrition, the sales office for Hunan Huacheng Biotech, has seen a sales increase of more than 100% during the past two years, he says.

Greenberg explains that organic and conventional monk fruit extracts range from approximately 100-300 times sweeter than sugar, while monk fruit juice concentrate liquid is 15 times sweeter than sugar and ideal for beverage formulations or food formulations using a syrup or liquid.

For an ideal sugar replacer, Greenberg suggests using a one-to-one blend of monk fruit/erythritol. “The bulking aspect of sugar is represented by the erythritol and the sweetness of sugar is highlighted by the monk fruit extract,” he explains. “It allows diabetic safe, keto/Atkins/low carb friendly, low/zero sugar, and low/zero calorie options of your favorite sugary drinks, snacks, food and dietary supplements.

“Beverage formulators are like chefs. Similar ingredients, yet the usage levels change based on what the end result is planned for,” he continues. “A soda manufacturer will use a different combination of sweeteners than a protein beverage manufacturer will. Stevia is most known for its offnotes, so we advise a tri-blend of our monk fruit/stevia/erythritol blend.”

Like Greenberg, Icon’s King suggests less is more when formulating with stevia and monk fruit.

“All high-intensity sweeteners should be used in moderation. Stevia and monk fruit should be used in concert with other low-intensity sweeteners like allulose and erythritol for best results,” King says.

He points out that finding the right balance of sweetness can be challenging, especially when reducing or replacing sugar because each sweetening ingredient contributes its own nuances — some deliver in a quick burst, while others release sweetness more slowly.

To prevent offnotes and a bitter licorice taste, monk fruit and stevia typically are used in combination or with a modifier, King says. Icon Foods offers new natural sweetness modulators: CitruSweet, made with citrus peel extract, and ThauSweet, made with a compound found in the katemfe fruit, which can help with offnotes “not by masking but by extending the flavor experience,” he says. The clean-label modifiers also boost the capabilities of stevia and monk fruit to create a lingering sweet effect with the desired taste, King adds.

With more sustainable agronomy and production technologies like bioconversion and fermentation, experts note that the ability to scale sought after stevia ingredients like Reb M is helping to secure a “sweet future” for plant-based sweeteners. Likewise, sugar replacement options that can help reduce obesity, heart disease and other chronic health issues will continue to thrive.

As positive consumer perception and purchase intent have risen, consumers want to reduce the amount of sugar they’re consuming and to feel good about their beverage choices, Tate & Lyle’s Nichols says.

“Globally, stevia, erythritol, monk fruit and allulose have all been growing significantly, at a collective CAGR of 11% in beverages over the last five years,” Nichols says. “… Fifty-three percent of respondents to Euromonitor’s 2020 ‘Voice of the Consumer: Health and Nutrition Survey’ cited sugar reduction as their chosen method of weight loss. The further growth potential for these sweeteners becomes even more significant.” BI