Beverage R&D

Meeting the mark

Beverage-makers turn to natural sweeteners to reach sugar-reduction goals

By Lauren Sabetta

(Image courtesy of Reign Storm)

From pioneering inventions to scientific and medical advancements, the History Channel website lists antibiotics among the 11 innovations that shaped the course of human history, noting its use spread rapidly throughout the 20th century.

Similarly, today’s sweetener market is evolving rapidly, shaped by health and wellness trends and a rising demand for natural ingredients, experts note.

“With an increased focus on leading a healthy lifestyle and more scrutiny overall on ingredients, consumers are putting additional pressure on food and beverage manufacturers to offer products with clean label attributes,” says Erica Campbell, technical solutions manager for sweetening and texturizing solutions at ADM, Chicago.

“While there is not a single, encompassing definition for what constitutes a clean label, many shoppers review product labels for ingredients they deem as ‘closer to nature,’” she continues.

Meanwhile, consumers also see reduced sugar content as an important aspect of what they consider a clean label product to be, Campbell says.

“Many consumers also perceive naturally derived ingredients and low- or no-added sugar being crucial to supporting their overall well-being,” she explains. “These compounding factors drive consumers to have affinity for familiar sweetening ingredients, such as stevia, which not only checks the box on being naturally sourced but also helps reduce sugar and calorie content.”

Campbell adds that this level of label evaluation is even higher for beverages, which continues to be a focal area for sugar reduction and the incorporation of alternative sweetening ingredients.

“In fact, 57% of consumers state they review sweetening ingredients on beverage product labels,” she says, citing ADM Outside Voice. “More specifically, there is a spotlight on non-alcoholic beverages, with 69% of consumers stating sweetening ingredients are most important when purchasing new carbonated soft drinks (CSDs). Energy drinks (66%) and sports drinks (63%) follow closely behind for sweetening ingredient importance.”

Thom King, chief innovations officer at Icon Foods, Portland, Ore., notes that, alongside health-conscious shifts, regulatory influences are shaping the sweetener market.

“GLP-1 [glucagon-like peptide-1] agonists are igniting interest in reduced-sugar and high-protein products, as consumers look for solutions that align with their wellness goals,” he says. “This trend is likely just the beginning, with GLP-1s and [gastric inhibitory polypeptide] (GIPs) opening the door for peptides and other innovations to gain traction as research and awareness expands.

“Regulatory changes are also playing a significant role,” King continues. “FDA front-of-pack labeling guidelines, the TRUTH in Labeling act, updates to the school lunch program, and discussions around tariffs or taxes on high-sugar beverages signal a broader move toward transparency and healthier options.”

Amber McKinzie, marketing manager for sugar reduction at Cargill, Minneapolis, notes that governments across the globe are trying to reduce sugar intake — whether through regulations or taxation.

“They see it as a health priority, and they’re putting pressure on brands to manage sugar and calories across their portfolios,” she says. “Along with that, many customers are under tremendous pressure to meet their publicly announced sugar-reduction goals.

“Consumers are watching their sugar intake, regulatory bodies are keen to see CPG brands reduce sugar levels, and even shareholders are pushing for healthier choices,” McKinzie continues.

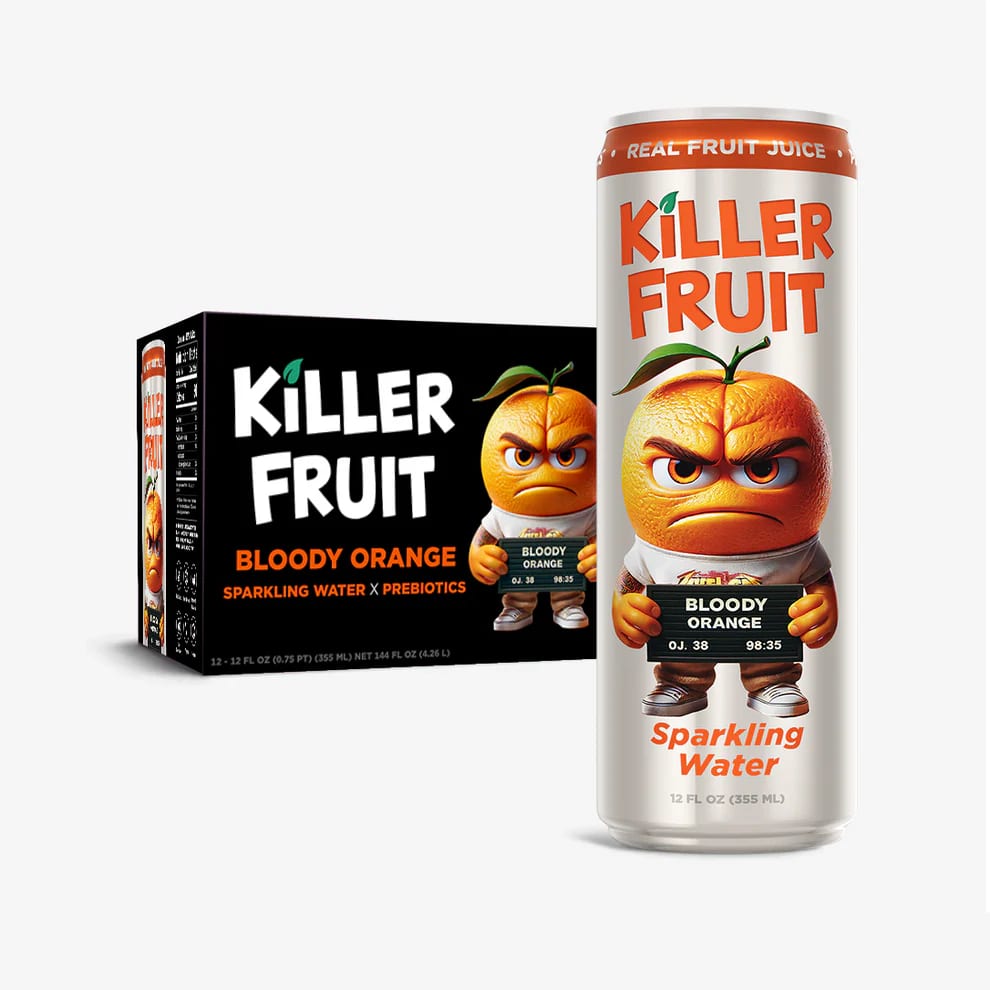

Available in three flavors, Killer Fruit is made with 12-16% real fruit juice and packed with prebiotics — each can is low in calories and made with no added sugar or artificial flavors, the company notes.

(Image courtesy of Killer Fruit)

Rising to the occasion

As beverage-makers increasingly embrace natural sweeteners, experts highlight the sweetener solutions that support the growing demand for lower-sugar options.

Becca Henrickson, head of category development for beverages at Tate & Lyle, Hoffman Estates, Ill., notes that manufacturers are gravitating toward more label-friendly sweeteners like stevia leaf extract and monk fruit.

“On the ingredient supplier end of this, we see emerging technologies coming to market that allow manufacturing scalability to drive down cost and democratize clean label ingredients that previously were inaccessible due to price,” she says.

Icon Foods’ King echoes similar sentiments, noting that stevia and monk fruit remain top choices due to their plant-based origins.

“Stevia is advancing rapidly with new technologies — particularly in bioconversion of steviol glycosides like Reb M — helping to shift its image away from bitter or licorice-like flavors,” King says. “These innovations are making Reb M stevia a more appealing option for beverages.

“Monk fruit is also gaining traction, especially when combined with Reb M stevia,” he continues. “The glycosides in both sweeteners — Mogroside V in monk fruit and Rebaudioside M in stevia — work together to balance each other’s off-notes, resulting in a neutral, more harmonious taste. This combination is especially beneficial in high-protein applications, such as beverages with over 20 grams of protein per serving.”

King adds that, as high-intensity sweeteners, stevia and monk fruit often are balanced with bulking sweeteners like allulose or erythritol.

“Icon’s KetoseSweet+ is a blend of allulose, stevia and monk fruit that offers a straightforward and effective sweetening solution,” he says. “Allulose is a saccharide that functions similarly to sugar, but doesn’t contribute added sugar to the nutritional facts panel. It’s an easy-to-formulate option for reducing sugar in a variety of beverages.”

Paul Orosco, fruits category manager at Global Organics, Cambridge, Mass., notes that innovating with fruit flavors available in concentrates versus not from concentrate (NFC) can help brands elevate their offerings.

“Organic White Grape Juice Concentrate is a versatile sweetener and flavor enhancer made from high-quality organic grapes,” Orosco says.

Meanwhile, Global Organics’ Strawberry Puree — a naturally sweet ingredient — can be used to enhance the flavor and color of a wide range of beverage products, including smoothies, mocktails and dairy products, he notes.

Sweetened with monk fruit, AZ Lemonade Stand’s AZ-ZERO offers a flavorful experience with zero sugar and calories, the company says.

(Image courtesy of AZ Lemonade Stand)

Innovative solutions

Beyond meeting sugar reduction trends, experts note that beverage-makers also are gravitating toward natural sweeteners to meet consumer demand for low- and zero-calorie drinks.

“The naturally sourced, zero-calorie sweetener for which beverage manufacturers reach is greatly dependent on the beverage format and the formulation targets and requirements,” ADM’s Campbell explains. “For example, there are advantages to leveraging stevia or monk fruit for sweetness and erythritol or allulose in combination with flavor modifiers for mouthfeel.

“Using a sweetening system, which may leverage several different sweeteners, helps ensure all goals are met in new beverage developments, from the sensory experience to low-/no-sugar and -calorie targets, as well as cost and clean label demands,” she continues.

Campbell adds that advancements in agronomy, extraction and formulation knowledge have put stevia in the limelight by introducing new plant varietals that provide the highest performing attributes of the stevia leaf.

“Leading the way for cutting-edge stevia innovations is our newly introduced SweetRight Stevia Edgility, which extends our quality SweetRight Stevia Edge line,” she says. “SweetRight Stevia Edgility delivers a superior sweetening profile compared to other Rebaudiosides and stevia products in the market, supporting significant sugar and calorie reduction targets and helping beverage product developers increase solubility while managing costs.”

Smaro Kokkinidou, principal food scientist at Cargill, also considers stevia to be a big winner in new formulations.

“For brands who prefer leaf-based solutions, Cargill’s toolkit includes Truvia and ViaTech stevia leaf extracts. However, we’re seeing the most interest in our fermentation-derived stevia sweetener, EverSweet,” Kokkinidou explains.

“Notably, EverSweet brings us so much closer to the sweetness, quality and temporal profile of sugar,” he continues. “That great taste gives EverSweet a decisive edge over other stevia products, offering unparalleled versatility in application, minimizing the need for flavor modifiers and delivering deeper sugar reductions than were possible before.”

In addition to significant sugar and calorie reductions, Kokkinidou says, EverSweet also delivers compelling cost-in-use numbers compared with leaf-based stevia products.

“The potential savings are even higher when compared to full-caloric sweeteners, where relatively small reductions in sugar can add up to noticeable cost-in-use benefits,” he explains. “Plus, as a fermentation-derived stevia sweetener, it is less susceptible to external market factors as compared to traditional commodities.”

Amanda Sia, senior scientist for beverages at Tate & Lyle, notes the growing interest in sweet proteins like thaumatin and brazzein, both which can be found in tropical plants.

“These protein sweeteners are intensely sweet compared to sucrose, even more so than stevia or monk fruit,” Sia says. “However, some challenges prevent widespread adoption; some protein sweeteners impart a lingering taste in application, and the production infrastructure for these sweeteners is not yet robust to support mainstream use.”

Icon Foods’ King echoes similar sentiments, noting that protein-based sweeteners like thaumatin are gaining traction in the market.

“Thaumatin, about 2,000 times sweeter than sugar, acts as a sweetness modulator in small quantities, extending the sweet effect of other sweeteners like stevia,” he explains. “Icon’s ThauSweet DRM, a blend of thaumatin, Reb M stevia and soluble tapioca fiber, can be used on its own or with other sweeteners like allulose, erythritol, agave and even traditional sugar, to reduce added sugar.

“Thaumatin enhances flavors — savory notes included — without overpowering the formulation,” King continues. “Soluble tapioca fiber has gelling capabilities that add viscosity to improve mouthfeel in reduced sugar beverages, which often have a thin mouthfeel.”

“Using a sweetening system, which may leverage several different sweeteners, helps ensure all goals are met in new beverage developments, from the sensory experience to low-, no-sugar and -calorie targets, as well as cost and clean label demands.”

– Erica Campbell, technical solutions manager for sweetening and texturizing solutions at ADM

What to consider

With sugar reduction and clean label trends continuing to impact beverages, experts highlight key factors to take into account when working with natural, zero-calorie sweeteners.

“Factors like taste, texture and functionality should be considered when working with these types of sweetening solutions,” ADM’s Campbell says. “For beverages, formulators must also keep solubility and stability of the sweetening solutions top of mind. Affordability also continues to impact consumer purchasing decisions, and certain sweetening ingredients may have higher cost-in-use.

“Overall, it’s crucial to start with quality sweeteners and find synergies within a sweetening system,” she continues. “We use our Replace Rebalance Rebuild method, which replaces sweetness, rebalances flavor and rebuilds functionality, alongside our high-quality, low- and no-calorie sweeteners, to build systems addressing both performance and value.”

Campbell further notes that by bringing flavor technology into the formulation from the start can help ensure the best sensory experience is achieved.

“Our TasteSpark flavor modulation technology elevates reduced- and zero-sugar beverages by masking off-notes or astringency, in addition to rebalancing key sensory characteristics like mouthfeel,” she says.

Icon Food’s King says that supply chain stability and price reliability should be top priorities for beverage makers.

“It’s crucial to understand COGS, ensure the stability of the supply chain, and confirm that ingredients are readily available,” he explains. “Consistent sourcing of stable raw ingredients is key, especially when it comes to maintaining price stability and keeping costs predictable for at least a year.

“Getting the formulation right in terms of flavor and mouthfeel isn’t really that hard — at least not when you’re working with an experienced formulator,” King continues. “The real challenge is making sure the product can be produced at a competitive price, getting it on shelves and making a profit. The last thing any beverage-maker wants is a product that’s priced too high to be competitive, especially in today’s market where consumers are constantly having to watch their spending.”

Cargill’s Kokkinidou suggests that finding the right sweetener system begins by defining your product development goals.

“It’s easier to develop reduced or no-sugar-added sweetening systems for new-to-the-world products as compared to reformulations,” he explains. “With reformulations, you have an expected sensory experience to try to replicate. New products are free of those constraints, but every application brings its own unique challenges.”

Additionally, Kokkinidou recommends that formulators take a holistic approach to product development.

“Sugar equivalency values (SEVs) only take you so far. You also need to consider things like temporal profile changes,” he says. “Many stevia products have delayed sweetness onset and lingering sweetness, when compared to the sucrose they replace. Selecting the right sweetener or sweetener blend can allow a characterizing flavor to shine and deliver an overall great sensory experience.”

Lastly, Kokkinidou notes that taste is the final arbiter of success — above all else.

“If a product doesn’t taste great, nothing else matters,” he says. “However, with the tools available today, brands can deliver on taste and meet consumers' other demands, too.

“It sounds like a big ask, but we have the tools and the expertise to deliver on taste, sugar and calorie reduction, and label expectations. With our help, brands can truly hit the sweet spot in beverage formulation.”Kokkinidou concludes.

Hybrid systems crucial to formulations

When it comes to formulating with natural sweeteners, experts note that no single solution exists that meets every goal and solves every challenge.

“Label considerations, sugar-reduction and/or calorie-reduction goals and cost-in-use requirements are among the factors we consider with every project,” says Smaro Kokkinidou, principal food scientist at Cargill. “Further, each application brings its own unique challenges. That’s why we’ve developed a portfolio of sugar-reduction tools that includes sweeteners like stevia, erythritol and allulose, along with other supporting ingredients like texturizers and emulsifiers.

“Especially for higher levels of sugar reduction, it may be necessary to use sweetener blends, pairing a high-intensity option like stevia with other complementary sweeteners,” he continues. “Erythritol and allulose are popular choices, as they can boost stevia’s up-front sweetness, round out its sweetness profile, and help build back mouthfeel.”

Kokkinidou further notes that, in the United States, when used at low, flavor-with-modifying-property (FMP) levels, both erythritol and allulose can be labeled as a natural flavor.

“Other supporting players include hydrocolloids like pectin and carrageenan, which can help replace missing body in a soft drink or add creaminess to a reduced-sugar dairy beverage,” he says.

Thom King, chief innovations officer at Icon Foods, notes that by combining different types of sweeteners, manufacturers can achieve a more consistent and desirable sweetness profile.

“High-intensity sweeteners like stevia and monk fruit, paired with bulking sweeteners like erythritol and allulose, along with fibers to add viscosity, create a more sugar-like sensory experience,” he explains. “Just as an orchestra creates a richer, fuller sound than a piano solo, combining sweeteners creates a fuller sensorial experience to deliver a more balanced taste and enhanced mouthfeel.”

Amanda Sia, senior scientist for beverages at Tate & Lyle, notes the trend of combining stevia and sugar in beverage formulations, as exemplified by brands like OLIPOP and poppi.

“Some consumers are willing to accept a modest sugar content for better flavor, finding the trade-off in calories worthwhile,” she says. “Additionally, the synergistic effect of sugar and stevia often results in a sweetness greater than the sum of its parts. Sugar also contributes to a fuller body, addressing a common challenge in low-calorie beverages. Lastly, this approach gives product developers more formulation flexibility.

“For example, perhaps a lemon-lime flavor would express better with more sugar, but another flavor such as grape might perform strongly even with low sugar,” Sia continues. “For instance, we are seeing some OLIPOP SKUs coming in at 35 versus 50 calories due to different sugar content. By leveraging these hybrid sweetener systems, beverage makers can create products that better align with consumer preferences for taste while still maintaining a relatively low calorie and sugar profile.”

1

2

3

3

2

1

Applied Food Sciences (AFS) announced the launch of PurGinseng, a premium, highly water-soluble 100% Panax ginseng extract poised to simplify food and beverage formulation. Ideal for applications such as beverages, stick packs, and effervescent tablets, PurGinseng offers an innovative solution for brands seeking to enhance their product offerings with adaptogens, it says. PurGinseng is sourced exclusively from 100% non-GMO Panax ginseng root and standardized to contain 8% (plus or minus 3%) ginsenosides, the active compounds responsible for ginseng’s potent health benefits. These ginsenosides have been shown to offer numerous health benefits, including enhanced physical and mental performance, improved stress response, and bolstered immunity, according to the company. Applied Food Sciences also announced that PurGinseng has achieved GRAS (Generally Recognized As Safe) determination for a Panax ginseng ingredient standardized specifically to ginsenosides. “At Applied Food Sciences, our mission has always been to push our capabilities of innovation in the natural ingredients space,” said Loretta Zapp, CEO of Applied Food Sciences, in a statement. “We recognized the growing demand for adaptogenic ingredients that could deliver real, measurable benefits, especially in the functional food and beverage industries. But we also knew that safety and regulatory approval were critical for any new ingredient to succeed in today’s market. That’s why achieving self-determined GRAS status for PurGinseng was a top priority. It allows brands to confidently integrate this powerful, time-tested adaptogen into their products, knowing that it meets the highest safety standards.”

Quality Smart Solutions has launched GRAS Experts, a new division aimed at tackling ingredient safety concerns and helping businesses stay ahead of regulatory changes and avoiding recalls. “Everyone’s talking about food safety right now, and for good reason,” said Andrew Parshad, president and founder of Quality Smart Solutions, in a statement. “The McDonald’s recall is a stark reminder of what can happen when ingredient or food safety isn’t airtight. GRAS Experts was created to help businesses avoid these exact scenarios by ensuring their ingredients are proven safe and fully compliant with evolving regulations.” As more companies face scrutiny over what goes into their products, the GRAS (Generally Recognized as Safe) process has become a critical standard for ingredient approval. GRAS Experts simplifies this complicated process, providing businesses with expert guidance to secure GRAS status for their ingredients, navigate Health Canada approvals, and meet EFSA Novel Food regulations. Additionally, the Toxic Free Food Act just introduced, complicates the compliance process. The issue being the self-affirmed GRAS pathway (not filing with FDA) gives any novel ingredient supplier the ability to put together a dossier or evidence without a government agency vetting it. The Act proposes to end that and require that novel ingredients mandatorily be filed with FDA. GRAS Experts was designed to successfully navigate this process, it says. With a dedicated team of regulatory specialists, GRAS Experts takes the stress out of compliance, helping food manufacturers and ingredient suppliers prevent costly recalls and protect their reputation.

NutriScience Innovations LLC announced its acquisition of XSTO Solutions LLC, a value-added supplier of nutraceutical and functional ingredients. The transaction adds six new branded products to NutriScience’s portfolio of ingredients and strengthens the company’s role as a preferred ingredient supplier to leading brands in the wellness, food and beverage industries, offering innovative ingredient solutions that meet consumer demands across all key health benefit categories, it notes. The new products feature unique benefit areas and include PepZinGI (gut health), K2Quest (bone and cardiovascular health), BenfoPure (blood glucose control), and NiaXtend (cardiovascular and healthy lipid level support), among others. “We are excited to partner with XSTO as we continue to grow NutriScience. We have deep respect for Francis Foley and Daniel Murray and admire the organization and reputation they have built over the last two decades,” said NutriScience CEO Alan Yengoyan, in a statement. “XSTO aligns perfectly with our mission to deliver science-backed, effective nutritional solutions that consumers want. This acquisition not only strengthens our portfolio but also enhances our ability to serve our customers and supply partners in the industry.”

Applied Food Sciences (AFS) announced the launch of PurGinseng, a premium, highly water-soluble 100% Panax ginseng extract poised to simplify food and beverage formulation. Ideal for applications such as beverages, stick packs, and effervescent tablets, PurGinseng offers an innovative solution for brands seeking to enhance their product offerings with adaptogens, it says. PurGinseng is sourced exclusively from 100% non-GMO Panax ginseng root and standardized to contain 8% (plus or minus 3%) ginsenosides, the active compounds responsible for ginseng’s potent health benefits. These ginsenosides have been shown to offer numerous health benefits, including enhanced physical and mental performance, improved stress response, and bolstered immunity, according to the company. Applied Food Sciences also announced that PurGinseng has achieved GRAS (Generally Recognized As Safe) determination for a Panax ginseng ingredient standardized specifically to ginsenosides. “At Applied Food Sciences, our mission has always been to push our capabilities of innovation in the natural ingredients space,” said Loretta Zapp, CEO of Applied Food Sciences, in a statement. “We recognized the growing demand for adaptogenic ingredients that could deliver real, measurable benefits, especially in the functional food and beverage industries. But we also knew that safety and regulatory approval were critical for any new ingredient to succeed in today’s market. That’s why achieving self-determined GRAS status for PurGinseng was a top priority. It allows brands to confidently integrate this powerful, time-tested adaptogen into their products, knowing that it meets the highest safety standards.”

Quality Smart Solutions has launched GRAS Experts, a new division aimed at tackling ingredient safety concerns and helping businesses stay ahead of regulatory changes and avoiding recalls. “Everyone’s talking about food safety right now, and for good reason,” said Andrew Parshad, president and founder of Quality Smart Solutions, in a statement. “The McDonald’s recall is a stark reminder of what can happen when ingredient or food safety isn’t airtight. GRAS Experts was created to help businesses avoid these exact scenarios by ensuring their ingredients are proven safe and fully compliant with evolving regulations.” As more companies face scrutiny over what goes into their products, the GRAS (Generally Recognized as Safe) process has become a critical standard for ingredient approval. GRAS Experts simplifies this complicated process, providing businesses with expert guidance to secure GRAS status for their ingredients, navigate Health Canada approvals, and meet EFSA Novel Food regulations. Additionally, the Toxic Free Food Act just introduced, complicates the compliance process. The issue being the self-affirmed GRAS pathway (not filing with FDA) gives any novel ingredient supplier the ability to put together a dossier or evidence without a government agency vetting it. The Act proposes to end that and require that novel ingredients mandatorily be filed with FDA. GRAS Experts was designed to successfully navigate this process, it says. With a dedicated team of regulatory specialists, GRAS Experts takes the stress out of compliance, helping food manufacturers and ingredient suppliers prevent costly recalls and protect their reputation.