feature

Launching a Corporate Health Care Design-Build RCx and MBCx Program

Grumman|Butkus Associates utilized a design-build retro-commissioning (DBRCx) approach to assist a large for-profit health care organization implement a nationwide retro-commissioning (RCx) program across multiple hospitals.

Design-build retro-commissioning (DBRCx) is a new approach Grumman|Butkus Associates (GBA) has developed to assist a large for-profit health care organization in implementing a nationwide retro-commissioning (RCx) program across multiple hospitals. During the past 10 years, RCx has become a standard method for achieving energy savings for institutional, commercial, and industrial facilities. Savings typically target 3%-6% of the utility bill and result in a one- to two-year simple payback of the direct measure costs (material and labor to implement the measure), not including the engineering effort to identify savings opportunities or provide measurement and verification (M&V) services. A typical project starts with an engineering team that identifies savings opportunities. The owner selects the measures, a contractor completes the implementation, and the engineering team verifies the savings; sometimes, third-party verification is also provided. Many local utility programs offer incentives ranging from covering the engineering analysis costs to cash incentives based on verified savings from the projects implemented.

In 2017, GBA was hired to implement a combined RCx and monitoring-based commissioning (MBCx) program across 27 acute care facilities. While the organization owns all the facilities, the hospitals are independently run by local C-suite and facilities teams. The portfolio varies in size (square footage), number of beds, and type and age of equipment. Some facilities have central heating and cooling plants with large, built-up, custom air-handling units with a central building automation system (BAS). Others rely on smaller, locally controlled DX systems.

Since the client does not have a corporate presence at each facility, the request for proposal (RFP) required that the selected team provide full turnkey services for each project. This included not only providing traditional RCx services but also developing engineering drawings and scopes of work, bidding the implementation of the measures, hiring the contractors, overseeing construction, providing project/construction management services, and verifying the energy savings through utility bill and trend analysis.

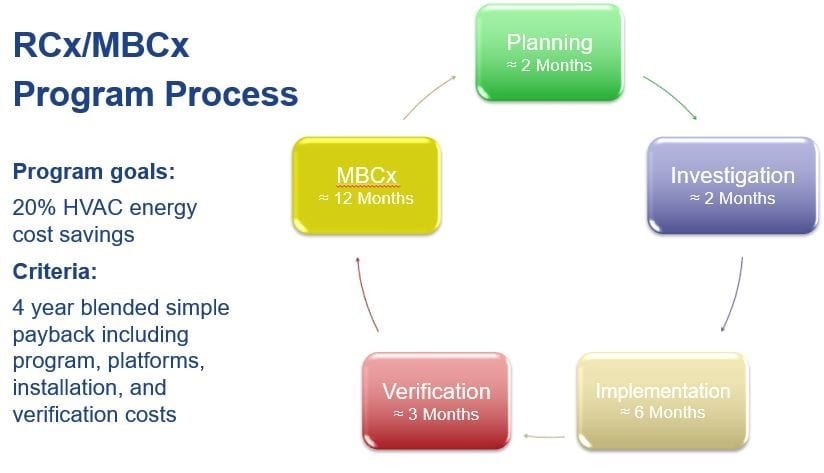

FIGURE 1: A synopsis of the retro-commissioning (RCx)/monitoring-based commissioning (MBCx) program process.

Images courtesy of Grumman|Butkus Associates

The client also wanted to launch a standardized MBCx platform at each site for two years to provide online trend data and to continuously validate the energy savings for the implemented measures. MBCx also helps verify the measures’ persistence over time. The client’s goal was for each site to save 20% of HVAC energy consumption with a full-program simple payback of four years. The program was funded by the client for four years with the corporation identifying the sites where GBA would launch the RCx/MBCx program on a rolling basis.

GBA, a full-service mechanical, electrical, plumbing, and fire protection design and energy consulting firm, has been providing licensed professional engineering services nationwide for more than 40 years. GBA has become a reputable source for HVAC infrastructure design, RCx, MBCx, and new construction commissioning for health care, higher education, laboratory, hospitality, and commercial buildings. As a consultant, GBA was not initially set up to hire contractors. To provide the turnkey services requested by its health care client, GBA created a new company, GBA Services, obtaining the necessary licenses and insurance policies dictated by the client and the authority having jurisdictions (AHJs) to hire the contractors to implement the work.

The turnkey/design-build project setup led to many challenges and successes for GBA and for the client, some of which are summarized below.

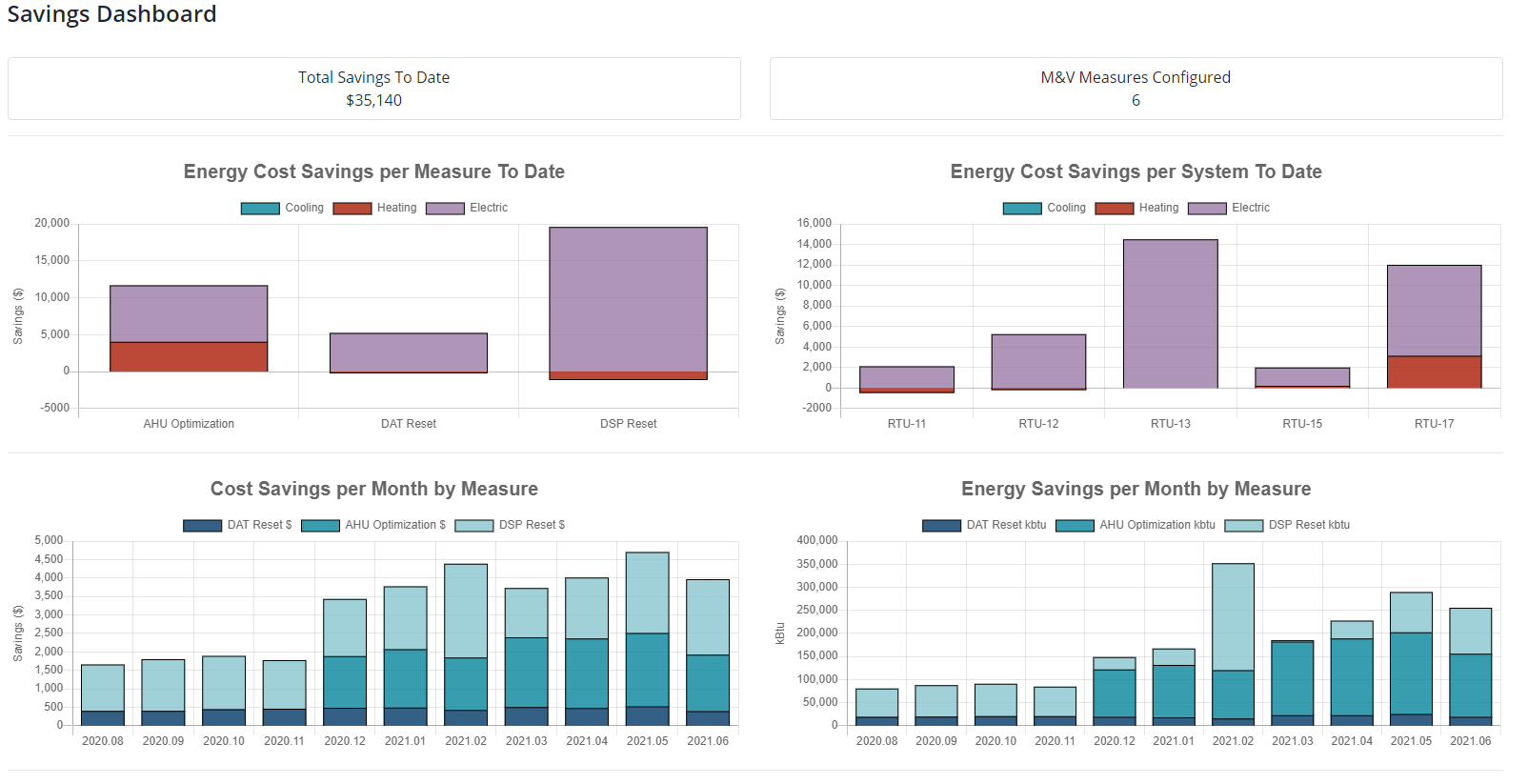

FIGURE 2. Verified cost savings of the implemented measures.

Project Successes

Speed: If corporate red tape or utility protocols are not constraints, DBRCx can have significant schedule advantages over the traditional RCx planning, investigation, implementation, and verification phases.

- Advantages can come as quickly as the first site visit by having the controls contractor on-site with the DBRCx team to immediately implement improvements as approved by the site team.

- The DBRCx team can establish national or local agreements with contractors to expedite the contracting process and avoid purchase order delays. Vendors not in corporate’s accounting system can still be hired promptly since the purchase order (PO) can be issued by the DBRCx provider.

Single Point of Contact/Less Owner Staffing: Streamlined communication and responsibility to the DBRCx team optimizes owner staffing and the internal workload.

- This can be highly advantageous for owners without internal corporate or project-site project management teams to handle multiple vendor interactions. GBA was responsible for coordinating site visits with contractors and the local site teams, overseeing installation of work and commissioning the systems.

- A single member of the owner’s staff can oversee the DBRCx provider and many projects, significantly reducing the owner’s direct labor staffing requirements. However, the cost savings from reduced owner involvement does shift to the DBRCx provider and may come at a higher price.

Transparency: Unlike a traditional performance contract, where the owner is “blind” to the process, GBA reviewed all measures selected for implementation with the site operations staff and the client, procured multiple bids for implementation and shared results with the client, submitted actual trend data and went through a detailed calculation spreadsheet and M&V review process, and did a final utility bill verification of savings. The DBRCx provider can be held more accountable than a typical performance contractor, giving the owner confidence the dollars spent and savings achieved are real and justified.

Technology: The DBRCx provider can often bring enhanced technology and expertise to the owner.

- The DBRCx provider is often very experienced with building automation control systems and newly available technologies, beyond the expertise of the owner’s on-site staff, and is therefore able to recommend and implement changes and improvements unknown to the owner’s team.

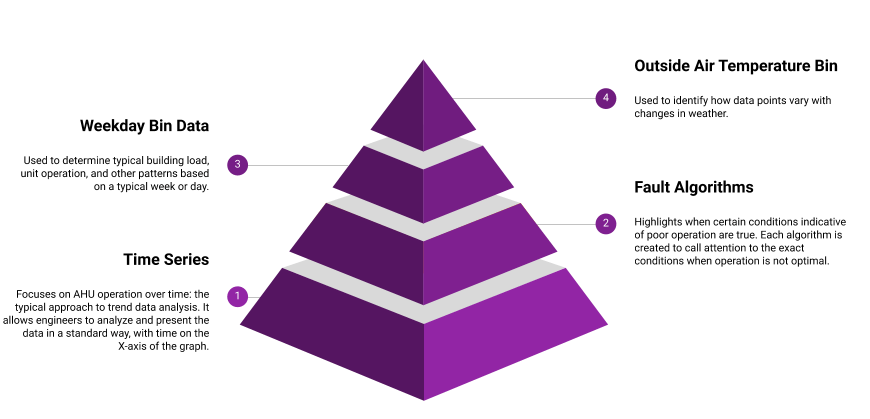

- A fault detection and diagnostics (FDD) or MBCx platform overlayed to the building automation controls system can help the DBRCx provider and owner identify building, system, and equipment issues that can turn into operational and energy improvement opportunities and savings. GBA has developed an in-house FDD tool, Trend Sumo®, but numerous third-party platforms exist.

FIGURE 3: GBA's in-house fault detection platform (Trend Sumo®) workflow.

- GBA was given the “authority” to implement sequence of operations changes. (Typically the BAS controls contractors who service the owner’s sites will resist making changes or improvements, because they do not have the authority.)

Financial savings: If the right DBRCx provider is selected, the owner can see improved financial returns and payback for dollars spent since the same provider is doing all the steps from planning, investigating, implementing, and verifying. This assumes the selected DBRCx provider can provide or oversee all these tasks.

Project Challenges

Cash flow for the DBRX team. Owners wishing to leverage the DBRCx process may be slow payers. This means delayed payments to the DBRCx provider and its subcontractors, which can lead to work schedule issues or difficult negotiations over payment terms.

Less information and details for the owner. By its nature, the DBRCx process puts all the responsibility for producing results on the DBRCx provider. This means the owner is significantly less involved in the details and financials for the projects.

- We recommend the owner and DBRCx provider thoroughly review, and agree on, a process for being kept up to date on the project and financials.

Less involvement from the owner means more work for the DBRCx team with the project site teams.

- The DBRCx team may often hear: “Who are you, and why are you here?” or “Oh, it’s that corporate program thing.”

- Considerable time may be “wasted” getting site operations staff up to speed and understanding the DBRCx process.

- The owner’s site staff may not easily grasp why it needs to be engaged in the process, but staff’s intimate knowledge of site operations and their buy-in is critical for the success of a DBRCx project.

Conflict of Interest: If the DBRCx provider is solely tasked with calculating the energy savings, providing financial estimates, and verifying the savings, this scenario can be a potential conflict of interest.

- The owner and DBRCx provider should thoroughly review, and agree on, the metrics and calculation methodology that will be used for energy savings calculations and the methodology for verification of savings.

- Are energy calculations and verification measure-specific? Or is verification done through whole-building utility bill analysis?

- The owner and DBRCx provider need to agree on the performance measurement and verification protocol that will be followed.

Capabilities of the DBRCx provider:

- Engineering consulting firms may be experts in the planning, investigation, and verification of retro-commissioning and energy savings measures, but they may lack construction management experience to smoothly execute project implementation.

- Contractors and construction management firms that offer DBRCx services often excel at construction implementation, but they may lack the depth of knowledge of detailed energy savings calculations and M&V protocols to satisfy owners as well as relevant utility incentive programs and auditors.

In addition to the successes and challenges listed above, GBA has some lessons learned for future projects.

Selection of sites: If a corporation-wide program is being implemented, GBA recommends working with the DBRCx provider in the selection of sites and the order for implementation. Going by physical size or using a marker, such as an ENERGY STAR score, does not paint the whole picture of a site’s operations, especially in the health care field. A number of factors, such as staff availability, type and age of the equipment, relationship with the local controls contractor, and vintage of the BAS, all contribute to the success of a project. GBA recommends a preliminary review of the utility data along with a one-day site visit to each facility, allowing the DBRCX provider to interview site staff and review existing operations and condition of the BAS. Each facility in a portfolio can then then be ranked according to RCx/MBCx potential. Some sites may end up requiring so much infrastructure or capital work that the owner may opt to save them for later phases or remove them from the DBRCx program.

BAS conditions: The BAS does not need to be the latest and greatest for a project to be successful; however, if the system is so out-of-date that new sequences of operations cannot be programmed, it is a nonstarter. Additionally, if traditional M&V through trend analysis is planned, trending in the BAS is needed. Data loggers can be utilized, but a large-scale data logger approach is slower and more cumbersome than utilizing the BAS. An MBCx platform is an alternative option for trend analysis, as discussed below.

MBCx platform: Depending on the MBCx platform type, the BAS system or the controls network itself may need to be upgraded. This should be evaluated for each site at the start of the project.

- All MBCx platforms require a large amount of data to be transferred across the network, so, if the BAS still runs on an old twisted-pair network, the MBCx platform will operate very slowly or with significant limitations and may possibly impact the main functions of the BAS itself.

- Additionally, MBCx platforms require a significant onboarding effort financially as well as engineering time. To launch the platform, a full analysis of the BAS is required, including equipment lists and existing drawings. Point-to-point verification is required either by the engineering team or the MBCx provider. While some platforms advertise “auto-discovery,” GBA has not found this to be streamlined on complex facilities and systems.

FIGURE 4: Pre and post measure implementation trend data.

Operations and Maintenance (O&M) Issues: For each site in a multisite program, GBA recommends that corporate allocate $20,000-$50,000 upfront for O&M issues found during the initial investigation phase. These issues typically impact the normal operation of a system, such as problems with dampers or actuators, but fixing them may result in minimal, or hard-to-quantify, energy savings. Nevertheless, dollars are required to repair these issues so implementation of the identified measures can succeed. If such items have to be included in the measure costs, the simple payback is negatively impacted.

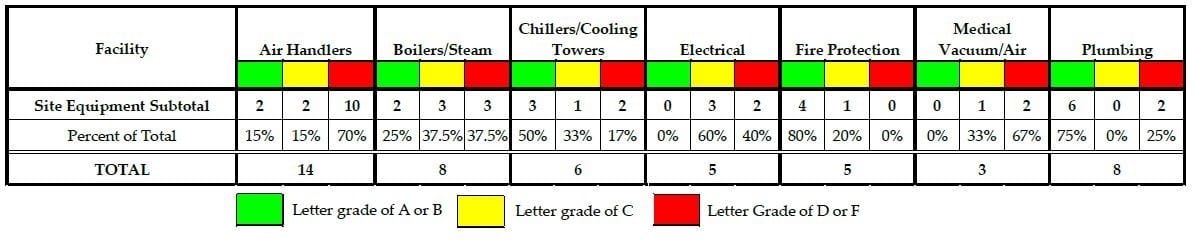

Infrastructure/Capital Planning: During the course of the investigation phase, many opportunities may be identified that, when bid to contractors, might not meet the program’s simple payback requirements. The item then becomes a capital measure. GBA recommends the owner coordinate capital planning with the site teams and the DBRCx provider so that during future projects the additional measures identified can be included when appropriate or budgeted for future work. GBA has created a tool called an Infrastructure Report Card that grades a site’s MEP equipment based on general conditions and energy efficiency, which can provide a capital roadmap for replacement.

FIGURE 5: GBA's infrastructure report card summary table.

Overall, DBRCx can be an effective tool for large-scale energy savings initiatives, leveraging the expertise of the engineering provider and taking burden off the owner’s team. In the DBRCx initiative profiled in this article, 14 facilities have now completed the two-year project. The client has invested more than $9 million, resulting in a verified 19% HVAC energy cost savings and a 3.8-year simple payback, programwide. The results have successfully met the client’s program requirements.

Fiona Martin McCarthy, P.E., QCxP, BEAP, LEED AP

Fiona Martin McCarthy is a project manager, Grumman|Butkus Associates

Image by Gerd Altmann from Pixabay