DISTRIBUTOR FOCUS

DISTRIBUTION DIVE

A quarterly column by the ACD featuring the latest updates in chemical distribution

Video: realrocking / Creatas Video+ via Getty Images

Chemical Supply Chain Braces for Onslaught of New Regulatory Burdens

By Eric R. Byer, President and CEO, Alliance for Chemical Distribution

Chemical distribution, and the chemical industry more broadly, is central to the well-being of American families, contributing to the health, safety, and convenience of our daily lives. In fact, the chemical distribution industry is a major component of the U.S. economy, employing over 75,800 people and generating more than $10.8 billion in tax revenue.

As a result, the industry and our supply chain partners, which include paint and coatings professionals, have some of the most stringent compliance requirements in the United States.

Members of the Alliance for Chemical Distribution (ACD) are leaders in the chemical industry, upholding the highest standards of safety to ensure essential chemical products get where they need to be when they need to be there. Because the chemical distribution industry delivers products to nearly every sector, we are one of the most regulated industries in the nation. Therefore, compliance with government regulations is of the utmost importance.

ACD keeps members informed on the pressing issues at the federal, state, local, and international levels, and assists with the legal and regulatory compliance required of businesses of all sizes, including many small businesses. Changes in the global landscape, economy, and political environment all play a factor in the policy and regulatory measures to which industry members must adhere. With the recent surge in regulations—from a variety of agencies— that are impacting our ability to remain competitive and adding burdensome costs across the chemical supply chain, we thought some additional analysis of these issues could be helpful to our partners in the paint and coatings industry.

The industry and our supply chain partners, which include paint and coatings professionals, have some of the most stringent compliance requirements in the United States.

Key Federal Agencies to Chemical Distribution

A broad range of federal agencies are involved in overseeing the regulations that impact the day-to-day business practices of our members and their supply chain customers. While some of these agencies are obvious, others are not so apparent. Some of the key agencies that administer the regulations with which our industry must comply include:

United States Environmental Protection Agency (EPA)

The EPA is responsible for overseeing federal environmental regulations, distributing grants, conducting studies that assess environmental risk, overseeing regulations on chemicals and pesticides, and managing policy on the EPA’s emergency response and waste programs. Of all the agencies, the EPA is one of the most heavily involved in chemical regulation.

United States Department of Labor (DOL)

The DOL oversees regulations for workers by setting standards and providing training, outreach, and educational assistance, often working through its Occupational Safety and Health Administration (OSHA), whose mission is to assure America’s workers have safe and healthy working conditions.

United States Department of Transportation (DOT)

Another key agency involved in our industry is the DOT, along with other key rail and maritime transportation staff who oversee and enforce national transportation policies. These include energy and hazardous materials transportation, commercial vehicles, rail safety regulations, and economic regulations of surface transportation and maritime trade.

United States Department of Homeland Security (DHS)

The DHS plays an integral role in regulating international trade, and customs and border patrol at our nation’s ports, overseeing counterterrorism, and managing the nation’s critical infrastructure.

United States Drug Enforcement Administration (DEA)

The DEA is responsible for regulating and enforcing controlled substances, some of which are chemical products.

United States Food and Drug Administration (FDA)

Accountable for the safety, efficacy, and security of drugs, biological products, and medical devices, the FDA ensures the safety of U.S. food supply, cosmetics, and other products, all of which rely on chemicals at their foundation.

Small Business Administration (SBA)

The majority of ACD members are small businesses that distribute, transport, and store chemical products, making the SBA crucial in preserving the nation’s competitive enterprise.

United States Trade Representative (USTR)

The chemical industry, and chemical distribution, is a global business. The USTR’s decision-making on U.S. interests, direct investment, and negotiations impact the planning and competition of the chemical distribution industry and the import of chemical products into the nation.

Onslaught of Regulations

While ACD members are taking steps to become more responsible, resilient, and productive than ever before, the recent onslaught of regulations from a variety of the above agencies, and others, threatens our ability to remain competitive and effectively supply our partners with essential products.

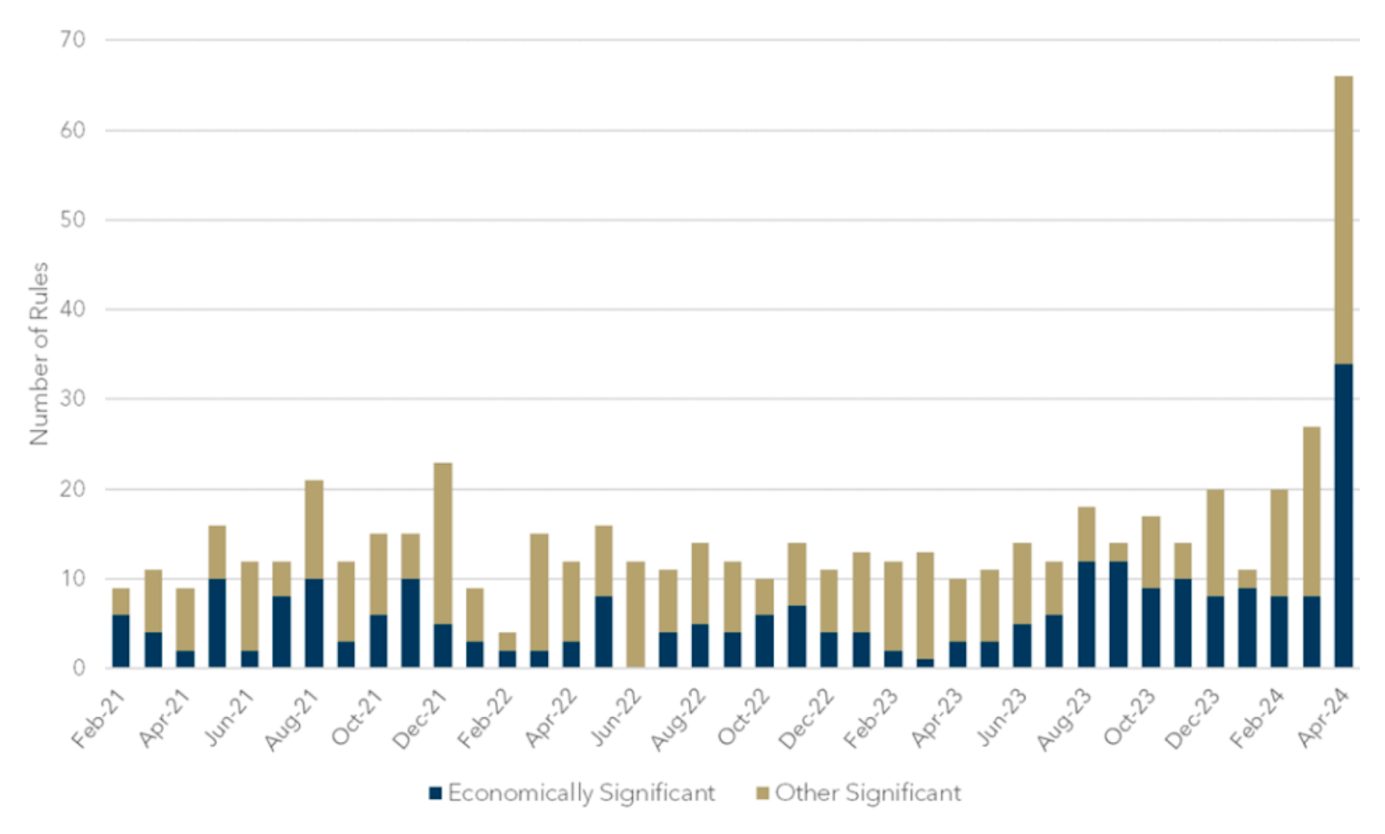

Based on a report released by George Washington University’s Regulatory Studies Center, federal agencies broke records in April 2024 by publishing 66 final rules, of which more than half are economically significant or likely to have an annual impact of at least $200 million on the economy. The number of final rules issued this past April is the highest of any month since the Reagan administration.

FIGURE 1–ǀ–Significant final rules published during the Biden Administration.

This surge of final rulemaking comes as the administration tries to protect its rules from being overturned by the Congressional Review Act (CRA). The CRA’s “lookback period” gives Congress the authority to review rules issued by the administration 60 days before the end of a session of Congress. This pace of rulemaking places significant uncertainty on businesses as they try to determine the near- and short-term impacts.

The newest regulations coming from the EPA, OSHA, and the U.S. Department of Treasury, among others, impose duplicative requirements and place significant burdens on businesses of all sizes across the chemical supply chain without delivering on their intended purpose. Unfortunately, American businesses and consumers are left to pay the price.

Some of the regulations that are impacting the chemical industry and our partners, like paint and coatings professionals, include:

- EPA’s Risk Management Program (RMP): For years, this program has had an impressive track record of preventing chemical accidents while improving preparedness efforts and environmental stewardship at chemical facilities. However, a recently issued EPA final rule to amend the program will now require facilities—even those in compliance—to implement costly new requirements into their businesses. Additionally, the new regulations will require facilities to disclose potentially sensitive information to the public. Unfortunately, the EPA has repeatedly failed to demonstrate the need for these sweeping and counterproductive changes. The agency should instead dedicate its efforts to noncompliant facilities to ensure everyone understands their safety and environmental obligations.

- EPA's Clean Water Act Hazardous Substance Facility Response Plan Program: Earlier this year, the EPA published the final rule, “Clean Water Act Hazardous Substance Facility Response Plans.” This rule establishes a new regulatory program that requires the owner or operator of certain facilities to prepare and submit a plan for responding to a worst-case discharge and the substantial threat of such a discharge involving a hazardous substance that could be expected to release into or onto surrounding navigable waters, adjoining shorelines, or the exclusive economic zone. This rule requires facilities to develop extensive modeling to determine whether they meet the rule's applicability criteria and mimics many existing requirements in other EPA regulations. ACD is concerned that compliance will be expensive and tedious, while not meaningfully improving facility safety.

- OSHA’s worker walkaround representative designation process: The final rulemaking on employee representation during OSHA inspections undermines the safety and security of chemical facilities by significantly changing who is permitted to serve as an employee representative during these inspections. ACD member facilities go to great lengths to ensure their products and processes are secure. This rulemaking gives unauthorized individuals access to these processes and facilities’ inner workings, which ultimately undermines their safety and security.

- Internal Revenue Service’s (IRS) reinstitution of the Superfund tax: The scope of the reinstated Superfund tax on more than 42 taxable chemicals and 151 taxable substances is far-reaching and complex. It nearly doubles the tax rate per ton for taxable chemicals, lowers the threshold for taxable substances from 50 percent to 20 percent, and increases the default tax rate from five percent to 10 percent. Since the reinstitution, the IRS has slow-walked clarifying its guidance for the countless businesses who are making good-faith efforts to comply with the law. ACD has repeatedly called for the IRS to provide more clarity and urged Congress to repeal these taxes.

- OSHA’s Indoor and Outdoor Heat Illness Prevention Rule: In a recently proposed rulemaking, OSHA is establishing requirements for how employers must monitor excessive heat in the workplace. Many businesses already address many of these concerns, including providing critical water and rest breaks, however, the new requirements under this rule will place additional red tape on businesses with new requirements for written plans, recordkeeping, and trainings. The impact of this rule will touch various industries that rely on chemical products, such as construction, maritime, and agriculture, among others.

These are only a few of the rulemakings that impact the chemical industry. Many of these new regulations are misguided and impose complex new requirements on businesses at a time when few can afford them. The additional confusion and heavy-handed red tape will likely have lasting effects as countless industries try to find the resources to comply.

Some of these regulations are particularly concerning as other security programs, such as the Chemical Facility Anti-Terrorism Standards (CFATS) program, remain expired. The lapse of this program, coupled with these new regulations, makes it harder for chemical facilities to ensure they have the tools and resources to protect themselves from possible threats.

The newest regulations coming from the EPA, OSHA, and the U.S. Department of Treasury, among others, impose duplicative requirements and place significant burdens on businesses of all sizes across the chemical supply chain without delivering on their intended purpose. Unfortunately, American businesses and consumers are left to pay the price.

Impact on Small Businesses and Chemical Supply Chain Partners

Many of ACD’s members are small, multi-generational, family owned businesses. Regulatory changes often leave companies with additional economic burdens and little to no benefit. While oversight from each agency helps to keep our industry running safely, it’s essential that we maintain an appropriate balance to ensure critical chemical products, including paint and coatings products that customers depend on, are manufactured, handled, and delivered efficiently. Overly zealous regulatory burdens can jeopardize this balance.

To put this into perspective, ACD’s economists, John Dunham & Associations (JDA), examined the revenue loss based on the changes made to the RMP program. JDA found that the proposed rule would cost the chemical distribution industry $36 million a year. This is significantly higher than initial estimates of $14.5 million a year made in 2022. After adjusting for inflation, the total cost for the 2,635 small firms indicated by the EPA would be $397.3 million, with an average cost-per-firm of approximately $150,700. That’s a lot of money for any business and has an especially significant impact on small businesses. Even more alarming, based on the price increases, JDA estimates that 200 full-time equivalent chemical distributor jobs would be lost, leading to nearly $57.37 million in lost wages and benefits.

The table below provides an overview of the economic impact of the proposed rulemaking revising the RMP program. The actual tenets of the final rulemaking, which was announced earlier this year, is likely to have even greater impacts.

TABLE 1–ǀ–Economic impact of the proposed rule amendments on the chemical distribution industry (EPA estimated cost).

Similarly, according to the American Chemistry Council (ACC), the reinstitution of the Superfund tax on chemical products would impose $1.211 billion per year on American chemical manufacturers, of which 60 percent would be passed through to purchasers. Using this data, JDA found that the total annual cost to the industry and its end-users would rise by over $996.9 million.

TABLE 2–ǀ–Estimated annual cost of superfund excise tax on chemicals.

Sadly, these are just two examples of the additional economic burdens placed on companies that are likely to lead to even greater economic consequences, such as limited hiring, diversion of resources to comply, and higher costs for supply chain partners and end-users.

As the industry continues to navigate these changes, ACD members are making good-faith efforts to ensure they are not only in compliance but upholding the highest standards of safety and security day in and day out. However, it’s important that any new regulatory change makes sense when implemented into business models across the chemical supply chain.