The BOTTOM LINE

- Consumers are searching for convenient snack options

- Better-for-you and clean-label is in demand

- Bars focus on immunity, energy, and digestion

Fueling on-the-go

Consumer preferences are skewing towards convenient bars

offering improved nutritional profiles.

Liz Parker Kuhn, Senior Editor

No longer just for gym goers and other athletes, the snack bar category has continued to evolve. Consumers are not just looking for on-the-go convenience, but also snacks that will nourish and keep them satiated throughout the day.

Brian Camus, president of Junkless, says consumers are looking for convenient snack options that taste great and have cleaner ingredients: “People want healthier options and they want functionality and less sugar, but one thing they won’t sacrifice is great taste. Consumers want permissibly indulgent snacks.”

BARS

STATE of the INDUSTRY

SPONSORED BY

Courtesy of Junkless

Market data

The snack bars/granola bars/clusters category overall had a decent year, according to Circana (Chicago) data from the past 52 weeks, ending on March 23, 2025. The category itself brought in $10.1 billion in sales and experienced a 1.9% uptick.

The nutritional/intrinsic health value bars subcategory brought in $5.1 billion of the lion’s share, with a healthy 5.3% in growth. Mondelēz International’s Clif Bar & Co. was responsible for $990.2 million but with a loss of 4.4%, and 1440 Foods, maker of the Pure Protein brand, garnered $658.1 million, with a 3.6% upturn. Quest Nutrition, parent company of Atkins keto-friendly bars, came in third, with $484.4 million and a small 0.8% increase in sales.

The breakfast/cereal/snack bars/clusters subcategory declined a bit (-2.7%) but still brought in $2.4 billion in sales. Kellanova, parent brand to RXBar, took in $707.6 million, a 12.3% decrease; private-label brands brought in $408 million, a 1.4% decrease; and Kind LLC, a Mars company, made $329.2 million in sales, a 1.3% increase.

The granola bars subcategory made $1.8 billion in sales, which constitutes a 5.6% decrease overall; General Mills led the pack with $727.5 million, a decrease of 7.3%. Private-label bars again came in second, with $301.9 million, constituting 11.3% growth; Quaker Oats Co., part of PepsiCo, brought in $226.4 million, a staggering decrease of 35.3% in sales.

Finally, the all other snack/granola bars/clusters subcategory was responsible for $765.6 million in sales, a 15% uptick. Nature’s Bakery brought in almost half of that ($306.9 million, a 13.9% increase). General Mills earned $146.7 million, a 24.2% increase, and Kellanova again made the list, with $102.8 million in sales constituting 17.4% growth.

HOVER OVER CHART TO SCROLL DOWN

Source: Circana OmniMarket™ Total Store View | Geography : Total US - Multi Outlet w/ C-Store (Grocery, Drug, Mass Market, Convenience, Military and Select Club & Dollar Retailers) | Time : Latest 52 Weeks Ending 03-23-25

Looking back

“We’ve found that consumers are really craving exciting new flavors and looking for bars that give them energy throughout the day,” says Emily Strobel, VP of brand marketing, Kind.

Sixty-five percent of adults are looking for more protein in their diet but do not necessarily know the best way to do so, she notes. “Today’s consumers want snacks that do more—they’re looking for energy, functional benefits, and bold flavors.”

Sri Kalapala, founder of Kailo, a new-to-the-market bar brand, says prior to the brand’s launch, he spent a considerable amount of time studying the market and speaking with consumers.

“People were either choosing bars that tasted good but had questionable ingredients, or clean bars that were forgettable. The most noticeable behavior shift I observed was toward intentional snacking. People want something they feel good about putting in their body, but they also want it to taste amazing and fit their lifestyle,” he notes. “People want snacks they can trust, made with recognizable ingredients.”

Courtesy of Mars

Max Groner, brand director, Bobo’s, says the bar category has been shaped by several consumer trends, including a strong focus on clean, transparent ingredients and a demand for convenient on-the-go options, with 50% of consumers choosing bars for quick snacks.

“Functional benefits like energy boosts and added protein have become key purchase drivers, with consumers increasingly seeking products that balance nutrition with taste. Additionally, we’ve seen a broader trend towards products that are gut-friendly and beneficial for digestion, and we believe oats are one of nature’s best original superfoods and great for gut health,” he notes.

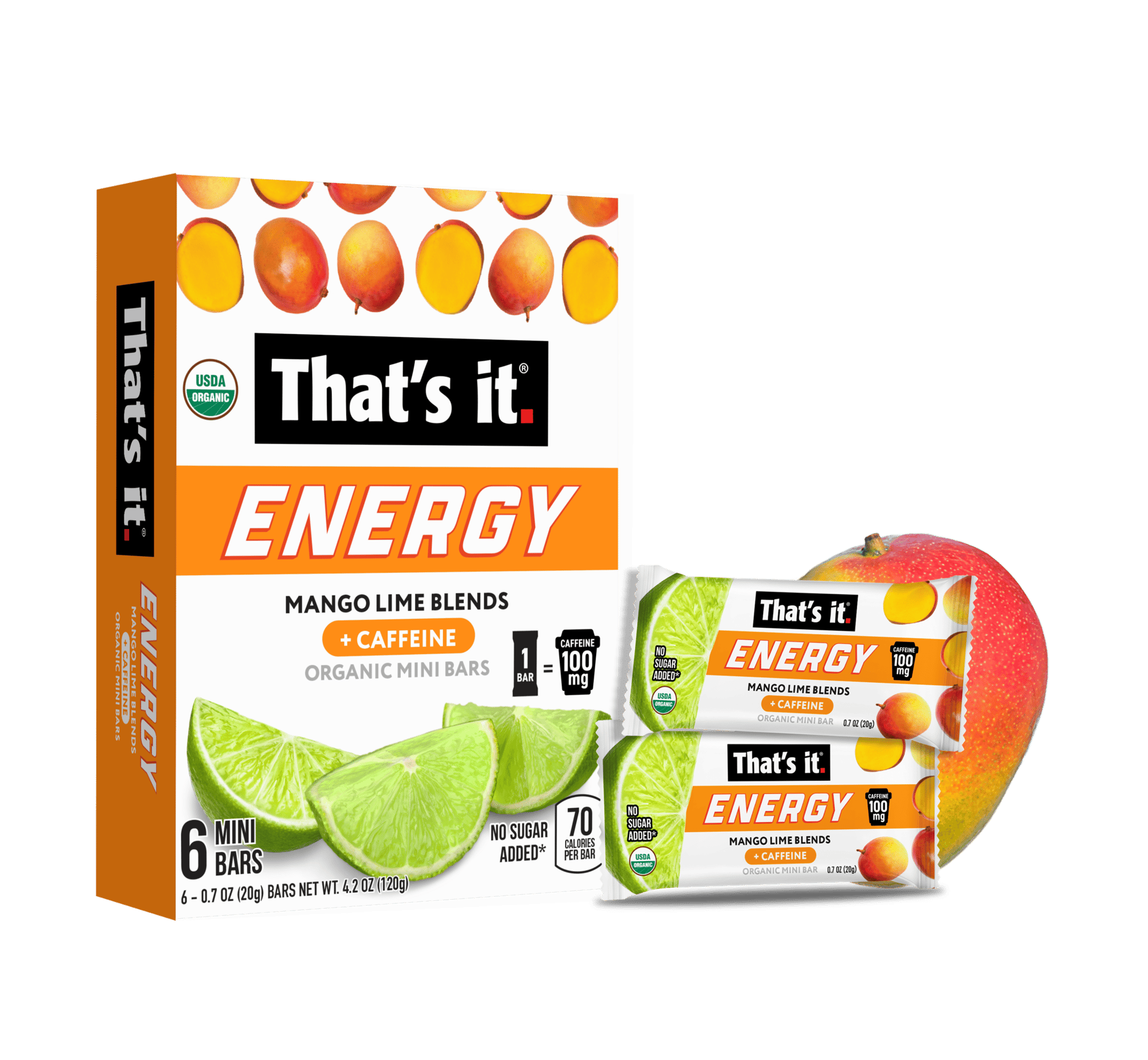

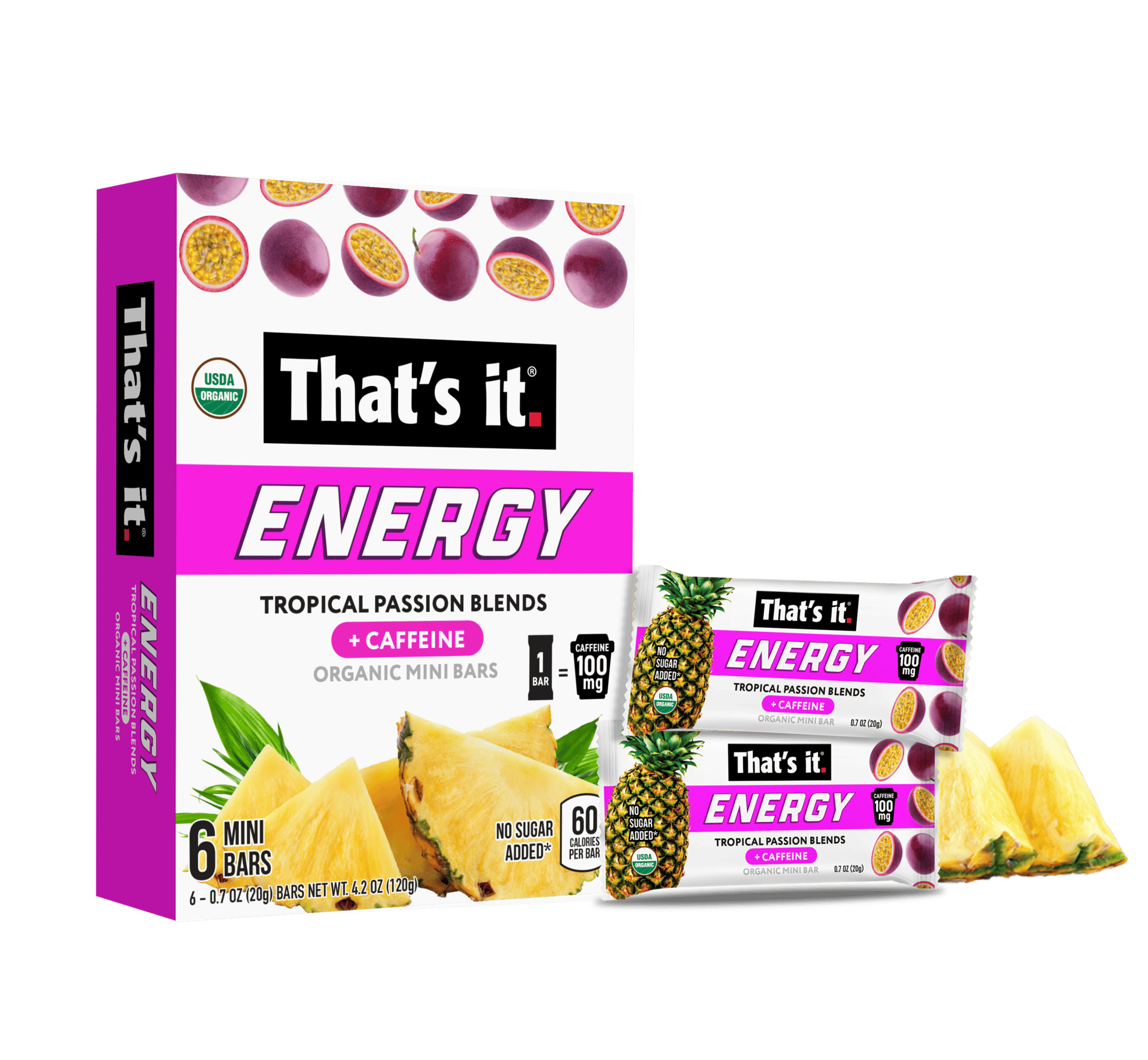

Katie Eshuys, president, That’s it., comments that transparency, minimal ingredients, and functional benefits really shaped purchasing behavior this year.

“Shoppers are scrutinizing labels more than ever and actively seeking out snacks that align with specific health goals—whether that’s reducing added sugar, getting more fruit and fiber, or clean energy without synthetic additives. We also saw demand shift toward multi-functional formats—snacks that don’t just taste good but do good, whether it’s energy, immunity, or digestion,” she shares.

Lior Lewensztain, founder of That’s it., says with recent legislation in several states banning certain food dyes and additives, there’s growing awareness around what’s actually in food.

“Parents, educators, and shoppers are starting to look beyond front-of-pack claims and take a closer look at ingredient lists,” he says. “That’s something we’ve been encouraging since day one. We’ve always believed that real food doesn’t need to hide behind vague terms or artificial ingredients.”

Alex Fishman, senior brand director, Pure Protein, adds that more and more consumers are looking to incorporate protein in their routines, and that's definitely been reflected in his business.

“Over the past few years, it's become more common knowledge that folks across all ages and levels of physical activity can benefit from a protein-rich diet. Accordingly, the bars category has become an ideal entry point for consumers to incorporate more protein into their daily routines. The old adage around protein bars ‘tasting like chalk’ is no longer accurate, and that's been reflected by the growth in the category,” he shares. “The category is continuing to evolve, and consumer expectations are heightening when it comes to taste and nutritional expectations. We always have to stay on top of the latest trends to ensure that our product offerings reflect what our customers are looking for.”

Courtesy of Pure Protein

Looking forward

Fishman anticipates continued growth in the category in the next year, especially as the trends for protein and nutrient-dense foods continue to grow.

“I foresee nostalgia continuing to trend, alongside an overall lightness and playfulness within the category—I think we're past the days of yore with gym and fitness-forward brands ruling the protein bar set,” he notes. “Producers across the board are navigating economic uncertainty with eyes on commodity pricing.”

Camus says the trends of consumers looking to reduce sugar and also increase protein in their diets will continue to grow.

“I believe they’ll transition from trends to mainstay consumer habits in the years to come. I also see the demand for functional benefits like gut health and immunity support continuing to grow across all food and beverage categories,” he predicts.

Ingredient sourcing and cost stability will continue to be a challenge, along with keeping an eye on inflation and pricing, Camus notes.

“Also, consumer trends and preferences are changing at an accelerated rate, which could be challenging, but we see that as an opportunity,” he says. “Our team is able to innovate and bring incredible new products to market quickly, giving us an advantage in meeting ever-changing consumer demands.”

Courtesy of Bobo's

Strobel anticipates continued growth in high-protein and functional snack offerings, as more consumers seek snacks that align with their wellness goals without compromising on taste.

“The demand for variety packs and convenient, on-the-go formats will also rise as consumers increasingly look to stock up and customize their pantry staples,” she observes. “We also see consumers are still looking for better-for-you snacks that feel like a treat. This is a trend we do not anticipate going away anytime soon.”

Kalapala says the bar market is moving toward a place where people care just as much about what’s in the bar as how it fits into their lifestyle.

“More consumers are reading labels, avoiding added sugar, and looking for snacks that actually make them feel good,” he shares. “At the same time, branding is becoming increasingly important. People want products that feel cool and intentional, not overly processed or ‘gym bro.’ I think we’ll see more bars made with simple ingredients that still feel elevated and stylish, which you’re excited to have set out on your counter or desk at work.”

Lewensztain agrees, saying thecategory will keep growing, but consumers are getting smarter—and more selective: “Smaller formats like minis will dominate, as shoppers look for ways to stretch their dollars and prioritize portion control, especially with the rise of GLP-1 medications reducing appetite. [Consumers] are now paying closer attention to price per serving, not just total price, reshaping how brands need to deliver value.”

Courtesy of That's It.

“Parents, educators, and shoppers are starting to look beyond front-of-pack claims and take a closer look at ingredient lists.”

— Lior Lewensztain, founder, That’s it.